"India’s long and deep association with wool makes it a natural partner for expanding our global collaborations and future growth."

Context & Opportunity

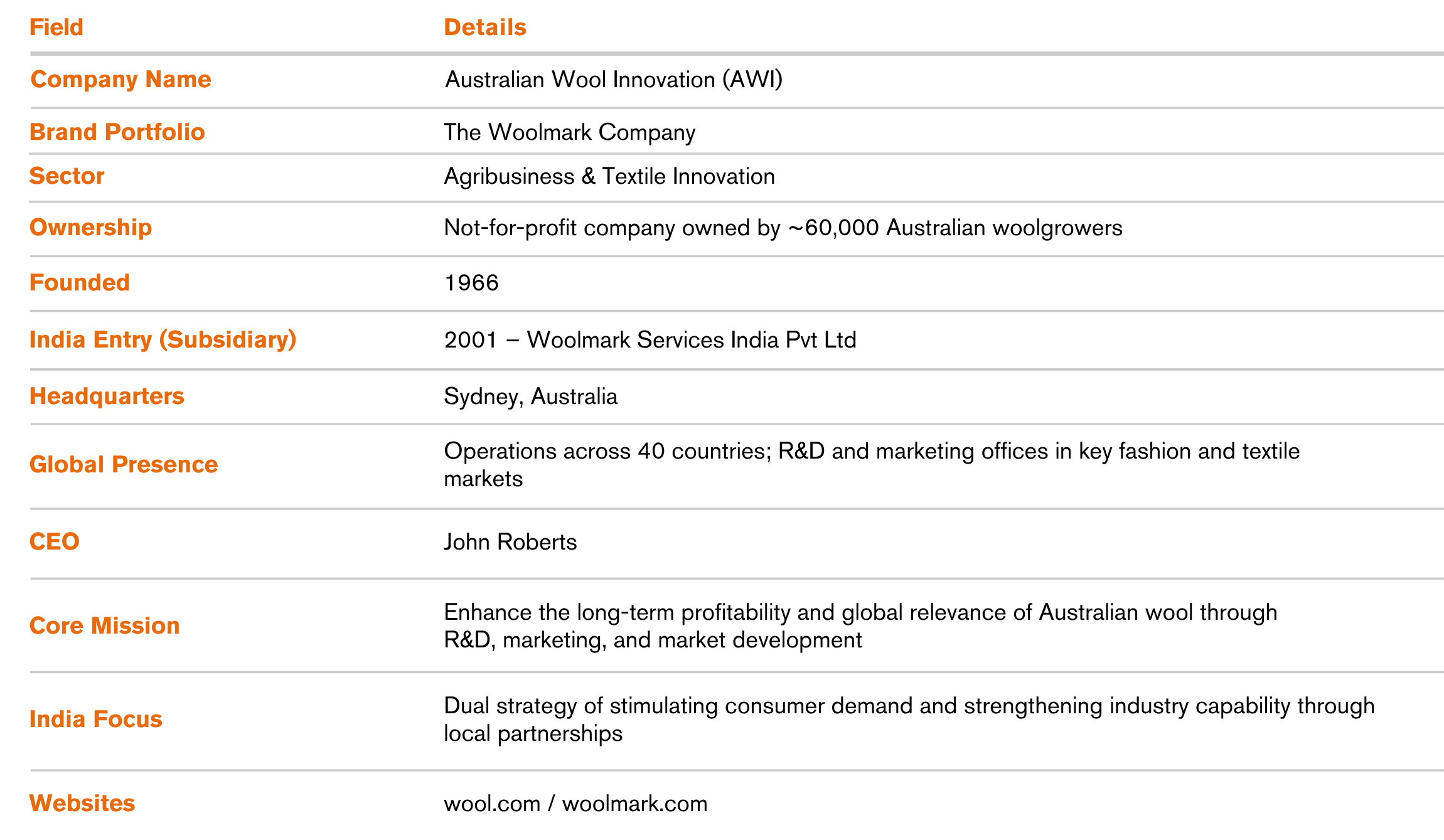

Australian Wool Innovation (AWI) is a not-for-profit company owned by over 60,000 Australian woolgrowers, serving as the research, development, and marketing engine behind the iconic Woolmark brand. Its mission is to enhance the long-term profitability and global relevance of wool, by investing in innovation and stimulating demand for Australian Merino worldwide.

India now represents one of AWI’s most strategic growth frontiers. The country’s fast-expanding middle class, rising disposable incomes, and appetite for natural, premium, and wellness-aligned fibres have made it a promising new consumer base. India is also the world’s fifth-largest economy and the largest global producer of textiles, combining a heritage of craftsmanship with modern, vertically integrated production capacity.

Historically, India accounted for just 5–8% of Australian wool exports, compared with China’s dominant over 80% share. Yet, as AWI CEO John Roberts explains, “India’s long and deep association with wool makes it a natural partner for expanding our global collaborations and future growth.”

India’s domestic wool output about 40 million kg annually is largely coarse wool, suitable for carpets but not fine apparel. This creates a strong structural import demand for fine Merino wool. The Australia-India Economic Cooperation and Trade Agreement (ECTA), which entered into force in December 2022, eliminated tariffs on Australian wool, providing duty-free access for Indian mills for the first time.

This policy shift, coupled with India’s modern spinning andapparel ecosystem and improving logistics and bilateral relations, transformed the opportunity. For AWI, India is both a market and a manufacturing hub, a chance to access new consumers, diversify export risk, and embed Australian wool in India’s textile and fashion value chain.

Strategy & Execution

In House Strategy

AWI’s India strategy is built around a two-fold approach: stimulating consumer demand and strengthening B2B industry capability. Traditionally, India was viewed mainly as a manufacturing base for export-oriented production. Over the past two decades, however, India’s rising incomes and growing fashion consciousness have repositioned it as a domestic consumer market. In response, AWI re-calibrated its model toward a near 50:50 balance between consumer marketing and industry partnerships.

The strategy is executed through Woolmark Services India Pvt Ltd, AWI’s local subsidiary founded in 2001, which runs training programs, fashion campaigns, and supply-chain collaborations across the country.

As Stephen Hill, GM International, of AWI India, notes, “Indian manufacturers increasingly see the Woolmark as the global symbol of trust and quality, while younger consumers are discovering Merino beyond traditional knitwear in sportswear, casualwear, even footwear.”

This shift has created a virtuous cycle: rising domestic demand increases imports of Australian Merino, driving local innovation and exports in turn.

Rather than a fly-in, fly-out model, AWI built a deeply localised presence. It invested in Indian textile specialists and marketers to ensure cultural and climatic relevance.

- Geographic focus: Consumer campaigns are centred on Delhi, Mumbai, and Bengaluru, urban markets with cooler climates, global fashion sensibilities, and digital reach.

- Industrial focus: Production engagement continues in Punjab, Ludhiana, and Tiruppur, long-standing textile hubs for spinning and garmenting.

- Retail partnerships: Collaborations with Reliance Brands, Aditya Birla Group, and online luxury portals like Tata Cliq Luxury and AJIO Luxe have expanded Merino’s premium visibility.

- Timing: Campaigns are synchronised with India’s October–March festive and wedding season, the country’s peak apparel spending window.

Marketing messages emphasise on two pillars, performance, and sustainability credentials. Breathability, odour resistance, and moisture management reframes wool as a multi-season, high-performance natural fibre, not just winterwear.

AWI’s campaigns are digital-first and co-branded with Indian retail partners. A standout example was the 2023 partnership with AJIO Luxe, fronted by celebrity stylist Anaita Shroff Adajania. The platform showcased 1,100 wool styles across 60 brands, generating 31 million impressions and a 28% year-over-year sales lift in wool apparel.

Beyond e-commerce, AWI sponsors fashion shows, design contests, and leverages the International Woolmark Prize alumni such as Rahul Mishra to inspire Indian designers. Collaborations with Louis Philippe brought Merino into golf apparel, while independent brands have introduced wool into yoga wear and sneakers, illustrating Merino’s versatility.

AWI’s India journey has evolved in three stages:

- Phase 1 (2000s–early 2010s): Capability building, training mills, conducting technical workshops, in textile hubs like Punjab, Maharashtra

- Phase 2 (2015–2020): Consumer awareness, retail tie-ups and “Grown in Australia, Made in India” campaigns.

- Phase 3 (2021 onwards): Leveraging ECTA, enhancing digital marketing, brand partnerships into emerging categories and promoting India as a regional re-export centre for wool textiles.

Ecosystem partnerships underpinned each phase. In 2022, the Australian High Commission and Austrade convened over 200 stakeholders at the Delhi Woolmark event. AWI also engages with the Wool & Woollens Export Promotion Council (WWEPC), Apparel Export Promotion Council (AEPC) and state textile clusters to build skills and processing capacity.

AWI’s India playbook stands out for its:

- Long-term commitment and capacity-building orientation.

- High-end positioning anchored in the Woolmark logo as a trust symbol, akin to “Intel Inside” for apparel.

- Integrated ecosystem model, linking growers, manufacturers, designers, retailers, and consumers.

This “farm-to-fashion” model ensures AWI captures value throughout the supply chain and embeds wool within India’s modern fashion and manufacturing systems.

Impact & Results

The India strategy has delivered tangible commercial, industrial, and socio-economic dividends for both countries.

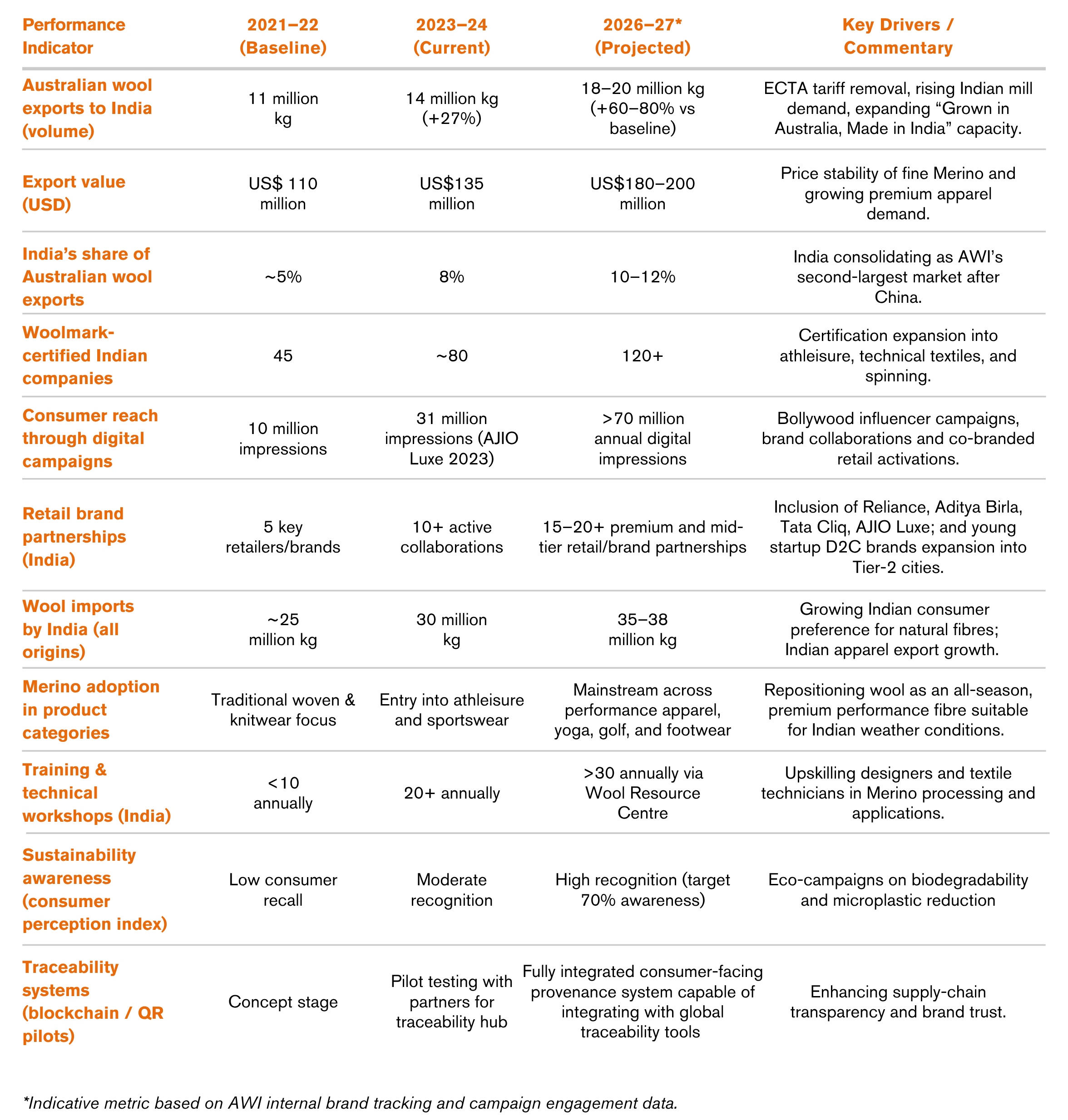

- Trade growth: By 2023, India imported 30 million kg of wool, up nearly 20% from pre-ECTA levels. Australian exports to India rose 27%, from 11 million kg (US$110 million) in FY 2021-22 to 14 million kg (US$135 million) in FY 2022-23, even though ECTA was in force for only six months that year

- Retail impact: AWI’s AJIO Luxe campaign drove a 25% increase in wool product listings and double-digit sales growth. Partner data show Merino lines achieving faster sell-through rates than comparable synthetic or cotton lines

- Industrial effect: ECTA-enabled tariff removal improved Indian mills’ cost competitiveness, leading to 10–20% growth in export orders for wool textiles by 2024. The number of Woolmark-certified Indian companies has also grown steadily, entering new categories such as athleisure and activewear

- Sustainability benefits: Wool’s biodegradability and microfibre-pollution reduction are now central to AWI’s India messaging, aligning with India’s sustainability-driven consumer movement

- Rural livelihoods: Rising demand supports Australia’s woolgrowers while AWI’s artisan and skilling initiatives in India sustain craft clusters and local jobs

Collectively, AWI has re-positioned India as the “second pillar” of the global Merino ecosystem, a living demonstration of how market development, policy, and innovation can reinforce each other across borders.

Lessons & Insights

Market Entry & Strategy

Reframed wool’s relevance for a tropical market by promoting its year-round performance qualities, breathability, odour control, and moisture regulation rather than winter exclusivity.

Adopted a phased, metro-first approach targeting cooler cities like Delhi, Mumbai, and Bengaluru before expanding nationwide.

Core Takeaway

Successful market entry in diverse climates requires re-educating consumers and validating demand in micro-markets before scaling.

Sustainability & Consumer Perception

Recognised the need to reclaim the sustainability narrative from synthetics, repositioning Merino as a renewable, biodegradable, and microplastic-free fibre.

Invested in consumer education campaigns and partnerships with eco-conscious designers to make sustainability aspirational rather than niche.

Core Takeaway

Owning the environmental narrative early helps natural products compete against fast-marketing synthetic substitutes.

Partnerships & Localisation

Built on-ground relationships through a permanent subsidiary, local marketing specialists, and culturally attuned communication.

Collaborated with Indian retailers such as Reliance Brands, Aditya Birla Group, Tata Cliq Luxury, and AJIO Luxe to embed Merino in mainstream fashion channels.

Core Takeaway

Deep localisation and credible partnerships build trust faster than short-term promotional campaigns.

Policy & Industry Readiness

Leveraged the Australia–India ECTA tariff elimination to gain price competitiveness and supply-chain access.

Converted policy opportunity into results through two decades of groundwork, mill training, certification programs, and trade-body engagement.

Core Takeaway

Trade reforms create openings, but only industry preparedness and ecosystem maturity turn them into growth.

Cross-Cultural & Organisational Learning

Adapted to India’s relationship-driven business culture through continuous in-person engagement, trust-based hierarchies, and digital follow-ups.

Relied on Austrade and local advisors to navigate regulations, trademark protection, and operational alignment.

Core Takeaway

Enduring success in emerging markets depends on patience, cultural fluency, and long-term institutional presence rather than opportunistic entry.

Over the next three to five years, Australian Wool Innovation (AWI) aims to lift India’s share of Australian wool exports into double digits, cementing the country’s position as the second pillar of the global Merino ecosystem. The company plans to launch digital-first consumer campaigns leveraging Bollywood and fashion influencers to make Merino the fabric of choice for India’s young, style-conscious consumers. On the supply side, AWI will expand its “Grown in Australia, Made in India” partnerships, positioning India as a global hub for wool innovation, design, and re-exports. This will be complemented by co-design programs and joint R&D initiatives with leading Indian textile institutes and technology centres, fostering collaboration between Australian fibre expertise and Indian manufacturing capability.

To deepen industry capability, AWI intends to establish a Wool Resource Centre to train designers and technicians in advanced applications of Merino. The organisation will also enhance traceability and certification systems, potentially using blockchain or QR-based provenance tools, to strengthen transparency and consumer trust across the value chain. Ultimately, AWI’s India playbook will serve as a blueprint for expansion into other emerging markets, ensuring a diversified, resilient, and sustainable global wool value chain.

All information has been verified from primary company submissions, official filings, interview transcripts, and secondary materials cited in the References section.

Company Snapshot

KPI Impact Snapshot