Context & Opportunity

Founded in 2010 by Naresh Kumar Kaushik, a robotics engineer of Indian origin, Tanshu Australia Pty Ltd began as a small fabrication workshop in Sydney equipped with a single fibre laser cutting machine and CNC press brake. Over the past fifteen years, the firm has evolved into a multi-vertical industrial enterprise spanning across metal fabrication, machinery solutions, robotics and automation, textiles, green energy, and logistics, now employing over 500 staff across Australia and India.

Tanshu today operates a bi-national model with Sydney as its global headquarters, and Sonipat (Delhi NCR) as its manufacturing base, where a new facility began operations in September 2025. The company’s founder describes this as part of a long-term plan to “redefine industrial excellence” by combining Australia’s precision engineering with India’s manufacturing depth.

Early experiments with importing fabricated metal parts from India exposed inconsistencies in supplier quality and production control. Rather than pursue a joint venture, Tanshu incorporated Tanshu India Pvt Ltd., a strategic greenfield manufacturing plant which ensures autonomy, faster decision-making, and uncompromised quality standards. In parallel, the company established NaviSync Freight Pvt Ltd. to internalise logistics and stabilise corridor freight costs, a venture “fully operational come October 2025.” Tanshu Vaidik India Pvt Ltd set up in 2021 has too seen growth in perfecting textiles products and solutions.

Naresh Kumar’s motivation was not purely commercial. His Indian heritage and technical training inspired a purpose-driven enterprise model built on reliability, sustainability, and trust.“Doing it ourselves gave us speed, confidence, and control,” he notes, a philosophy now embedded in every vertical of the business. Tanshu Australia’s values are anchored in respect, integrity, fairness, care, prudence, and innovation. They form the foundation of a culture that balances purpose with performance across every project.

Tanshu’s India expansion coincided with a favourable macro-policy window. India, one of the world’s fastest-growing economies (projected GDP 6–6.5 % in 2025–26), was deepening its Make in India program, while Australia sought supply-chain diversification and new trade corridors beyond China. Both governments committed to net-zero trajectories (2050 for Australia; 2070 for India), making Tanshu’s entry into green energy both timely and relevant. The Australia-India Economic Cooperation and Trade Agreement (AI-ECTA, 2022) further enabled tariff-free trade for most goods, creating a corridor of lower risk, higher efficiency, and faster growth.

Tanshu competes across a number of demanding sectors; advanced manufacturing, textiles, robotics and automation, logistics, and green energy, each dominated by entrenched global and regional incumbents.

- Machinery: Global heavyweights such as TRUMPF (Germany), Bystronic (Switzerland), Amada (Japan), and laser innovators like Coherent and IPG Photonics hold dominant shares in Australia, while in India, Sahajanand Laser Technology (SLTL Group, Ahmedabad) leads domestic production with advanced fibre and CO₂ systems.

- Logistics: NaviSync enters a field led by Australia Post, StarTrack, DHL Express, FedEx, and Toll Group domestically, and in India competes with Blue Dart (DHL) operating across 56 400 PIN codes and tech-driven carriers like Delhivery, which covers ≈ 18700 PIN codes.

- Green Energy: In India, Adani Solar (4 GW PV capacity) and ReNew Power (> 8 GW portfolio) dominate; in Australia, AGL and Origin Energy lead renewables investments toward net-zero compliance.

- Metal Fabrication: Matching product quality and pricing from Chinese metal fabrication companies for Australian, Indian and Pacific Island markets.

Against such scale, Tanshu differentiates through corridor agility, ownership of its supply chain, and the credibility of an Australian manufacturing brand localised for Indian conditions.

Strategy & Execution

Go-it-alone entry and local leadership

Before its official India entry, Tanshu spent two years sourcing fabricated parts from Indian vendors. Quality fluctuations and unreliable timelines undermined its export commitments, leading to a critical inflection. “You must have people on the ground in India… in the end, a decision was made to do it on our own,” recalls founder Naresh Kumar, a statement that now defines the company’s operating philosophy. Rather than pursue joint ventures that demanded shared control, Tanshu incorporated Tanshu India Pvt Ltd. in 2024 as a wholly owned greenfield entity. This structure delivered three immediate benefits: speed, quality oversight, and capital discipline.

The Sonipat facility (metal fabrication and machinery solutions began operations in September 2025, while the Panipat units (textiles) expanded concurrently, both under local management. Australian headquarters in Sydney maintained engineering design and finance oversight, creating a dual-market model that combined Australian precision with Indian scale.

This decision was easy following the establishment of Tanshu Vaidik India Pvt Ltd in 2021, and its subsequent success and sales growth.

Dual-market production and corridor logistics

Tanshu’s next move was to control freight volatility. Rising container prices and border delays during the pandemic had eroded margins, prompting the company to create its own logistics subsidiary. In 2025, NaviSync Freight Pvt Ltd. was established to rationalise corridor costs and improve supply reliability, “fully operational come October 2025.” This vertical integration created a capital-light logistics platform, allowing Tanshu to serve both its Indian and Australian bases while capturing freight margin internally.

At the same time, Tanshu invested in robotics, CNC technology, and fibre-laser systems. It imported premium machines from China for its Australian and New Zealand clients while designing assembly of similar equipment at Sonipat for the Indian market. The 2023 launch of Tanshu Green Energy Pty Ltd. extended this model into ESG-aligned verticals, adding renewable manufacturing to its industrial portfolio. Digital transformation complemented the physical build-out, online branding, social-media marketing, and preparation for cross-border UPI–PayID payments created a unified brand presence across both markets.

Governance, funding, and ecosystem enablement

Funding has been owner-driven, backed by family capital and strict cash-flow governance. Each subsidiary maintains independent accounting and compliance structures under group-level supervision. Governance is led by Managing Director, Naresh Kumar and Director of Operations, Shubham Kaushik, supported by local legal and finance teams in both countries.

Policy enablers like AI-ECTA (2022), Make in India incentives, and Austrade & AIBX support accelerated Tanshu’s corridor integration. Diaspora and family networks provided early market intelligence, while Austrade’s SME programs and Invest India’s facilitation services helped ease regulatory entry.

Ultimately, Tanshu’s playbook rests on three pillars:

- Greenfield control for speed, independence and quality;

- Integrated logistics through NaviSync to lower freight risk and improve cost-to-serve;

- Early ESG adoption through Tanshu Green Energy to align with net-zero targets.

This structured sequencing stabilising in Australia, scaling in India, and then integrating logistics and renewables has become the signature of Tanshu’s bi-national industrial model.

Impact & Results

Tanshu has transformed from a small Sydney workshop into a bi-national industrial enterprise with end-to-end capability across design, manufacturing, and logistics.

- Operational scale: The Sonipat facility is now producing metal fabricated parts and CNC and fibre-laser equipment, while Panipat exports textiles to Europe, USA and Australia. NaviSync Freight has added a strategic layer of control, creating new roles in Mumbai, Pune, Delhi, Chennai and Sydney.

- Reliability: A long-term Australian customer testified that “Tanshu has been 100 % successful with its deliveries since 2012, never failed to meet delivery dates.” This standard now anchors the firm’s India operations.

- ESG impact: The 2023 launch of Tanshu Green Energy Pty Ltd. supports the net-zero goals of both countries. Local hiring in Panipat and Sonipat creates community benefits, and high-efficiency equipment reduces material waste.

- Financial and trade efficiency: Through AI-ECTA tariff advantages and logistics integration, Tanshu has cut freight volatility and improved margins on exports to key markets in Europe, USA, Argentina, Japan and Australia.

The outcome: a cost-competitive, ESG-aligned industrial platform with faster delivery cycles, reliable exports, and a scalable corridor presence. As Naresh Kumar summarises, “Doing it ourselves gave us speed, confidence, and control, the next five years are about scaling that model globally.”

Lessons & Insights

Market Entry & Execution: The Case for Control

Tanshu’s entry experience demonstrates the limits of remote management and partnership dependency. Before its India expansion, the company spent two years testing supplier contracts.

Quality inconsistency, shipping delays, and lack of control over delivery timelines catalysed a shift from a supplier-import model to a fully owned greenfield operation, enabling Tanshu to control cost, time, and quality simultaneously.

Core Takeaway

For SMEs, entry speed is worthless without execution control. Establishing a local entity, however small, creates the accountability loop required for scale.

Governance & Policy Alignment: Balancing Opportunity and Friction

AI-ECTA (2022) eased tariff barriers but not the compliance and regulatory complexities of dual-market operations. Differences in tax codes, product labelling, and quality certifications between Australia and India caused early delays, reinforcing the need for tight governance.

Tanshu’s structure, owner-funded, family-backed, with local legal and financial teams proved essential to managing these frictions. Its founder’s dual cultural fluency eased entry but did not replace the need for formal, rule-based compliance.

Core Takeaway

Policy wins like AI-ECTA open doors, but robust governance keeps them open. SMEs must invest in financial discipline and cross-border legal literacy early.

Operations & Capability Building: Owning the Bottlenecks

Tanshu’s decisive choice to internalise logistics (NaviSync Freight, 2025) and establish parallel production (Sonipat and Sydney) converted two structural weaknesses; supply dependency and freight volatility into competitive strengths.

By vertically integrating freight, Tanshu now retains margin internally while improving corridor reliability. The establishment of Tanshu Green Energy Pty Ltd. in 2023 reflected a similar principle: sustainability is not an afterthought but a revenue enabler.

Core Takeaway

For mid-sized industrial firms, value-chain control matters more than sheer market share. Reducing operational friction compounds faster than chasing volume.

Strategic Foresight: Adaptability as the Growth Engine

Cultural fluency, digital readiness, and fiscal discipline emerged as the company’s three differentiators. Despite Naresh Kumar’s Indian roots, trust-building still required time, transparency, and consistent delivery performance. The company’s adoption of UPI–PayID interoperability for cross-border payments symbolises this flexibility, a small but telling signal of a digital-first mindset.

Tanshu now emphasises three enduring principles: 1. In-house strategy-making and local execution over outsourced control. 2. Tight financial management and owner-governed capital allocation. 3. Sustainable innovation embedded in product and process.

Core Takeaway

In corridor markets like Australia–India, success depends less on size and more on adaptability, the ability to pivot governance, culture, and systems in real time.

By 2025, Tanshu’s Sonipat plant began manufacturing metal parts and assembling CNC and fibre-laser machines for India and export markets, while Panipat continued textile exports to Europe, the USA, and Australia. NaviSync Freight will now evolve into a regional logistics leader, integrating supply chains across the Asia–Pacific corridor. Looking forward to 2027, Tanshu plans to deepen its robotics and automation projects through co-innovation partnerships and leverage India’s manufacturing momentum to enter Middle Eastern and Southeast Asian markets. The company’s goal is to position itself not merely as a supplier, but as a corridor-integrated industrial ecosystem that connects Australian engineering, Indian manufacturing, and regional logistics hubs under one model.

With India sustaining 6% + GDP growth and CECA negotiations promising deeper bilateral integration, Tanshu’s next chapter will test its ability to translate entrepreneurial discipline into institutional scale.

All information has been verified from primary company submissions, official filings, interview transcripts, and secondary materials cited in the References section.

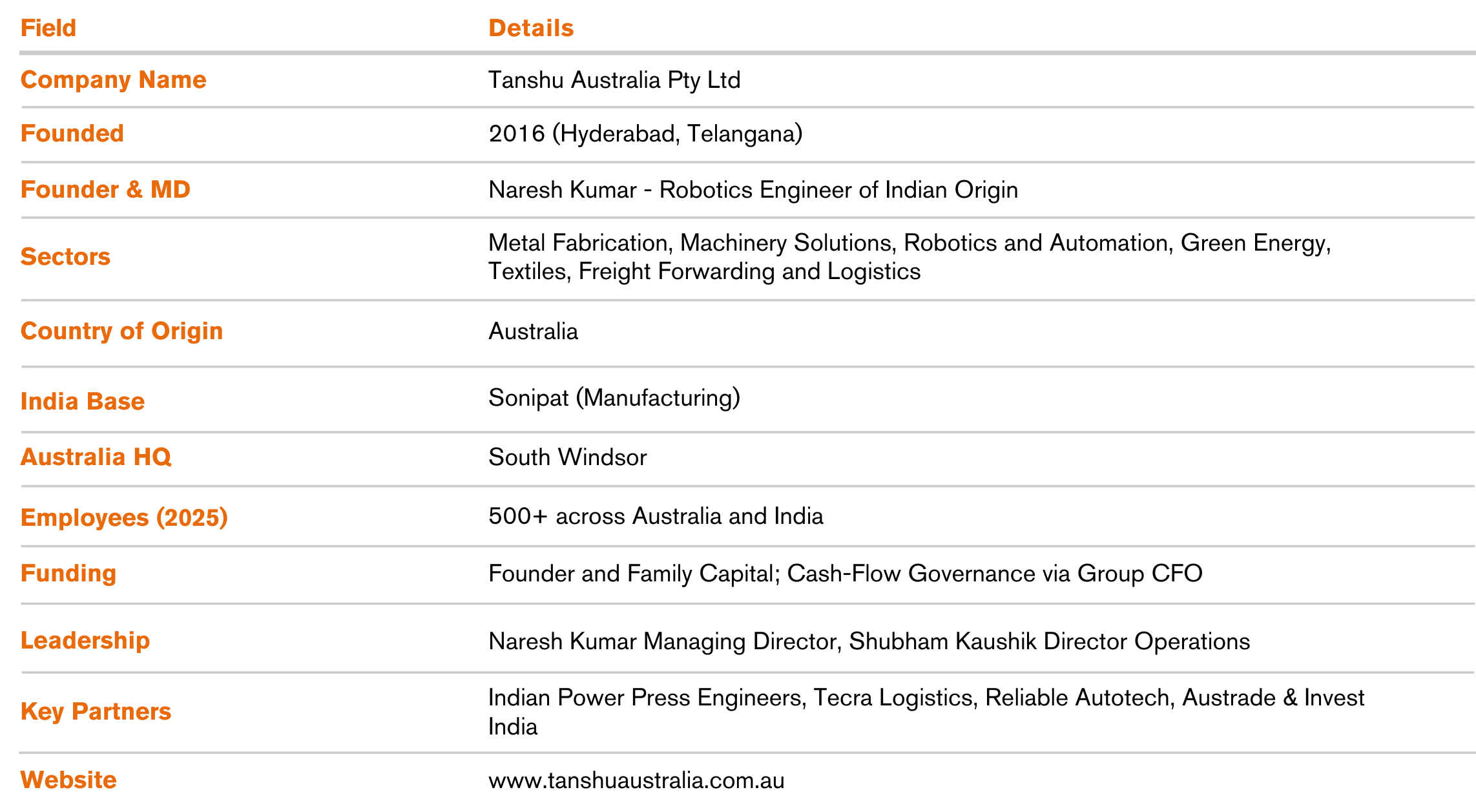

Company Snapshot

KPI Impact Snapshot