"We didn’t enter Australia as sellers, we entered as scientific partners in wellness."

Context & Opportunity

Founded in India in 2012, as a premium botanical-extract manufacturer, Sunpure Extracts Private Limited has grown into a science-driven MSME at the intersection of sustainability, wellness, and innovation. Its 360° extraction philosophy ensures each ingredient delivers the highest potency, purity, and bioavailability. Through the Sunpure Research Incubation Centre (SRIC), the company integrates R&D, regulatory science, and lean operations to deliver consistent global-grade quality.

By 2022, Australia emerged as a strategic frontier. Post-pandemic consumers were seeking clean-label nutraceuticals and functional foods aligned with evidence-based health outcomes. The fast-growing Indian diaspora also offered a culturally receptive customer base familiar with Ayurvedic ingredients.

A policy catalyst amplified this timing. The Australia–India Economic Cooperation and Trade Agreement (AI-ECTA) removed tariffs on herbal extracts and simplified import documentation, unlocking a high-value export corridor. For Sunpure, this marked a dual shift: from supplier to co-innovation partner, and from transactional exports to long-term capability building.

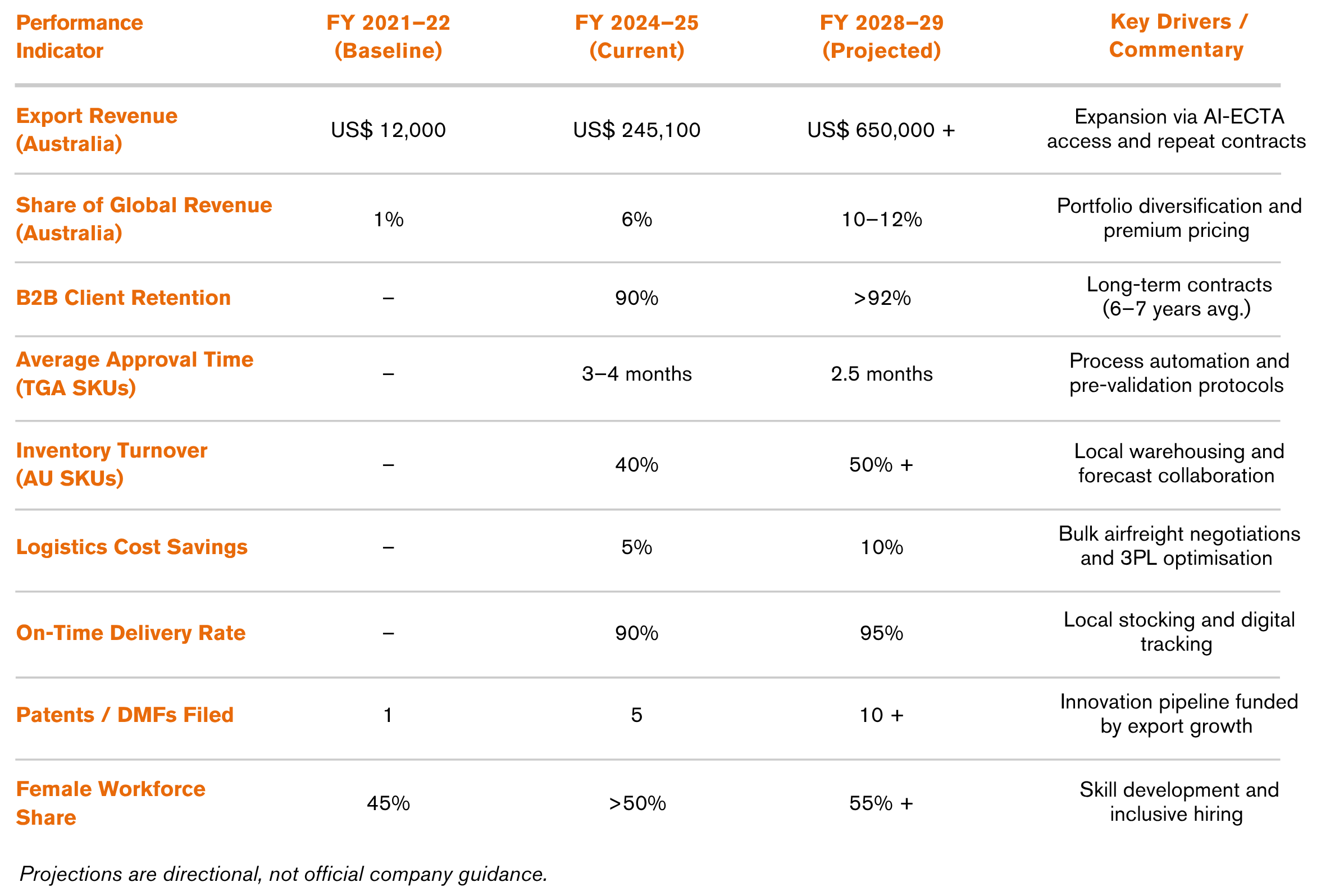

Australia’s nutraceutical sector has been expanding at ~45% YoY (in the premium functional segment). Within this landscape, Sunpure’s exports grew from US$ 34,560 (FY 22–23) to US$ 245,100 (FY 24–25), with Australia contributing ~6% of global revenue.

Strategy & Execution

To reflect its MSME agility, Sunpure adopted a distributor-led export model, partnering with The Health Ingredients and TransChem, two established Australian nutraceutical distributors. This allowed market access without fixed capital expenditure, while leveraging partners’ expertise in the Therapeutic Goods Administration (TGA) framework.

Sunpure re-engineered its internal systems to meet Australia’s high standards:

- Upgraded testing protocols for assay standardisation, microbiological content, pesticides, and heavy-metal profiling

- Introduced TGA-compliant labelling and documentation workflows

- Deployed third-party warehousing in Australia, cutting freight costs by ~5% and achieving 45% near-market fulfilment

- Reduced lead time to 7 days by air / 45–55 days by sea, with 90% on-time delivery

To serve Australia’s demand for efficacy and evidence, Sunpure launched liposomal formulations, sustained-release botanicals, and herbal patches, clinically validated and supported by internal patents and proprietary blended ingredients (PBIs). These offerings positioned Sunpure as an innovation co-partner, not a commodity supplier.

Cross-functional SRIC teams, spanning R&D, regulatory affairs, and exports enable rapid iteration and real-time feedback integration. Digital outreach (LinkedIn, webinars, and B2B campaigns) strengthened visibility with nutraceutical manufacturers and contract formulators.

- 3–4 major B2B contracts annually (US$ 30–40 K each)

- 70 SKUs cleared under TGA with 3–4 month approval cycles

- 20–25 MT exported annually, 80% by air

- Two specialists dedicated solely to Australian regulatory operations

Public-private engagement through India’s Export Promotion Councils amplified Sunpure’s credibility, while AI-ECTA benefits translated into tariff-free shipments and simplified customs clearances.

Impact & Results

Sunpure’s Australia playbook translated into measurable commercial and operational gains. Within two years, Australia–New Zealand became a top three export corridor, with shipments rising from US$ 34,560 (FY22–23) to US$ 245,100 (FY24–25) and contributing ~6% of global revenue. Growth quality was strong: 80–90% of sales came from repeat customers, driving ~90% retention while customer-acquisition costs remained contained at US$ 1,000–5,000.

Local third-party warehousing and joint demand planning with distributors lowered cost-to-serve and delivered ~5% logistics savings; service levels improved to ~90% on-time delivery with lead times of ~7 days by air and 45–55 days by sea. Inventory discipline strengthened, with AU-specific SKUs turning ~40% and near-market stock enabling 45% of orders to be fulfilled domestically.

Australia also became a live testbed for science-led differentiation. Feedback loops with B2B customers informed new liposomal and sustained-release formats and underpinned five patents/DMFs filed for proprietary blends, shifting Sunpure from commodity extracts to a co-innovation partner. Capability gains in assay standardisation, documentation, and TGA-aligned quality systems created a repeatable compliance engine that shortens approval cycles (3–4 months) and improves pricing power through value-linked documentation.

The strategy delivered positive ESG spillovers. A >50% female workforce, solvent-free extraction where feasible, reusable HDPE drums, and e-clearance reduced waste and administrative emissions, while expanded biomass sourcing supported rural livelihoods. Net-net, Sunpure converted AI-ECTA access, regulatory excellence, and targeted innovation into durable customer stickiness, lower logistics friction, and a defensible premium position in a high-barrier wellness market.

Lessons & Insights

Customer Education as Market Enabler

Many Australian buyers were unfamiliar with Ayurvedic actives. Sunpure bridged this gap via webinars, whitepapers, and demo formulations.

Core Takeaway

Science-based education converts curiosity into contract value.

Regulatory Foresight Reduces Friction

HS-code ambiguity and nutraceutical classification delays taught Sunpure to pre-engage TGA consultants before large shipments.

Core Takeaway

Compliance foresight is cheaper than post-hoc correction.

Value-Linked Pricing Strategy

Early pricing ignored the premium that buyers attach to documentation and traceability. Adjusting for compliance and lab validation improved margins.

Core Takeaway

In premium markets, value is proven through paperwork.

Lean Teams, Smart Networks

Instead of scaling headcount, Sunpure built a bench of external specialists, regulatory, marketing, logistics across time zones.

Core Takeaway

Networked expertise scales faster than payroll.

Innovation Through Feedback Loops

Australian feedback directly informed new SRIC formulations and clinical pipelines.

Core Takeaway

Treat export markets as living laboratories for innovation.

Compliance as Brand Currency

Early and transparent compliance created trust and differentiation.

Core Takeaway

In high-barrier markets, compliance is marketing.

Ecosystem Engagement Builds Endurance

Partnerships with trade councils and distributors anchored reputation beyond transactions.

Core Takeaway

Credibility compounds through ecosystems, not ads.

Sunpure’s next phase involves expanding its clinical and cosmeceutical ingredient portfolio, increasing patents and global DMFs, and partnering with universities for advanced formulation research. The company aims to cut time-to-market from 4 months to 2.5 months, double its Australian client base, and establish clean-label cosmeceutical leadership by FY 2028.

“Australia validated our science, strengthened our systems, and sharpened our strategy. It turned compliance into competitive advantage.”Amit Sharma, Vice President, Sunpure Extracts

By combining Indian R&D depth with Australian regulatory credibility, Sunpure is shaping a science-led export model that positions India as a trusted global wellness partner.

All information has been verified from primary company submissions, official filings, interview transcripts, and secondary materials cited in the References section.

Company Snapshot

KPI Impact Snapshot