Context & Opportunity

Founded in 2019 as a deep-technology spin-out from the University of Wollongong, Sicona Battery Technologies is developing next-generation silicon–carbon (SiCx®) anode materials for lithium-ion batteries. The company’s mission is to break two structural constraints in the global battery industry: the energy-density ceiling imposed by graphite anodes and the supply-chain risk created by China’s dominance in silane-gas-based silicon production.

As founder and CEO Christiaan Jordaan explained, “We knew that replicating what China does in Australia was not a winning strategy, we had to leapfrog to the next generation of anode materials.”

Sicona’s solid-state, silicon-metal-based approach enables faster charging, greater energy storage, and a diversified, safer global supply chain built on solid silicon feedstocks and recycled semiconductor wafers rather than hazardous silane gas.

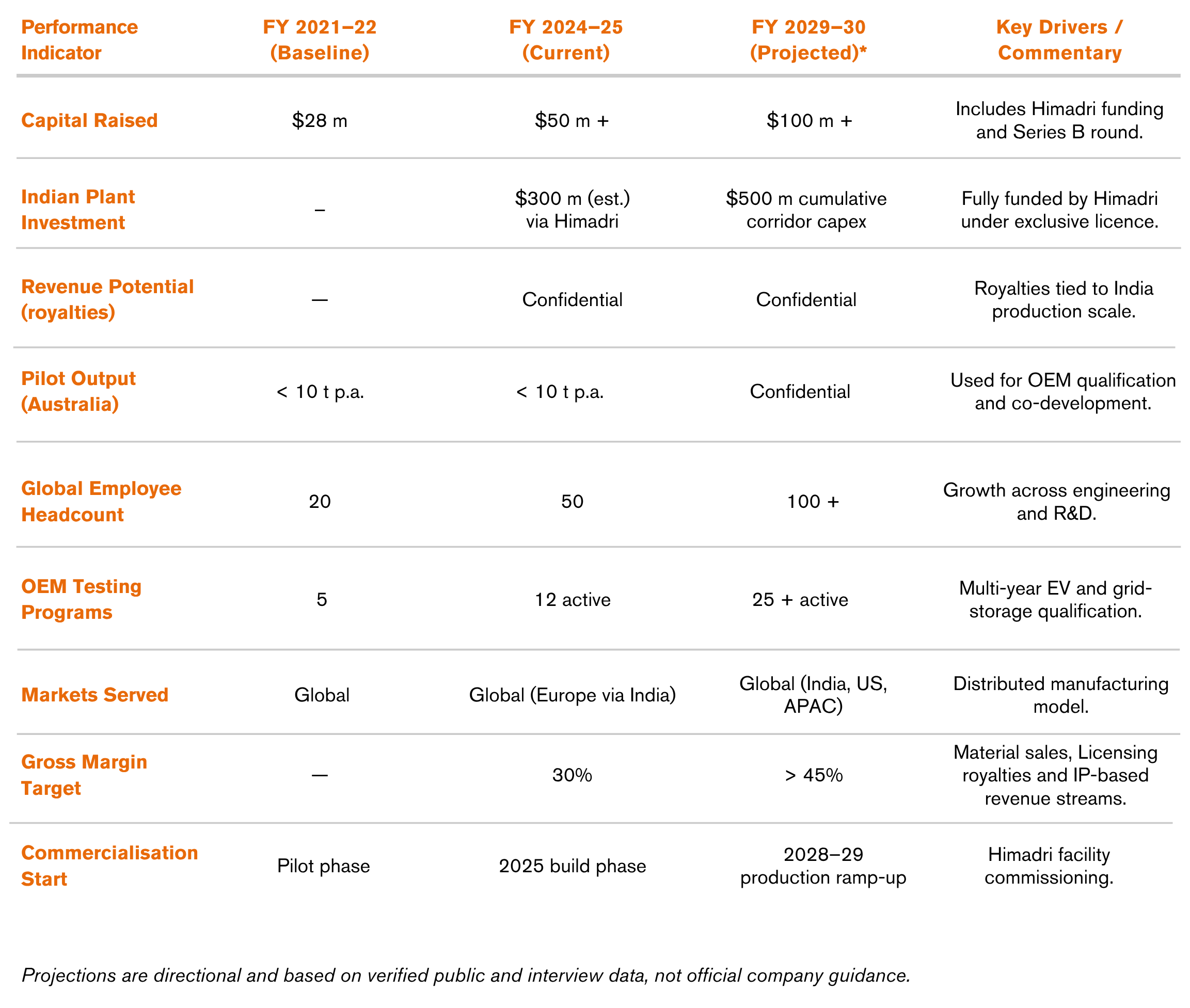

By 2025, the company had raised more than $50 million, including a $22 million Series A led by India’s Himadri Speciality Chemical Ltd., which became both investor and exclusive manufacturing licensee for India. Under this strategic licensing partnership, Himadri will fully fund the commercial-scale plant in India, an investment worth hundreds of millions of dollars, while Sicona retains intellectual-property ownership, royalty rights, and embedded engineering oversight. Sicona engineers will work on-site to ensure product quality, customer qualification, and co-branding alignment.

This model anchors a powerful Australia–India industrial corridor. Himadri gains world-class IP to pivot from commodity chemicals to high-margin battery materials, while Sicona accesses large-scale commercialisation without bearing full capital risk. The timing is pivotal: the silicon-anode materials market is projected to grow from US$0.2 billion in 2024 to over US$10 billion by 2030, driven by the accelerating global adoption of electric vehicles and grid-scale storage.

Global competitors rely largely on gas-phase production routes using silane (SiH₄), a hazardous, explosive material that 98% of the world’s supply derives from China’s polysilicon industry. This creates both concentration risk and high capital costs due to extreme safety requirements and complex processing equipment. Sicona’s solid-state route, by contrast, uses solid silicon metal and recycled wafer feedstocks, which are inert, transportable, and abundant across Australia, Brazil, Europe, and the United States. The process is safer, less capital-intensive, and geographically flexible, supporting distributed manufacturing close to end markets. It effectively decouples next-generation battery materials from the Chinese industrial ecosystem, creating an independent and resilient alternative for Western and Indian manufacturers.

Strategy & Execution

The silicon-anode market, expected to exceed US$10 billion by 2030, is growing at over 40% CAGR, fuelled by OEM demand for higher-energy-density batteries. India’s policy momentum, including the PLI scheme for Advanced Chemistry Cells and FAME II for EV adoption makes it a natural partner. Domestic cell-manufacturing capacity is targeted to reach 50 GWh by 2030, creating robust demand for silicon-rich anodes.

Sicona’s execution is defined by phased scaling: validating technology in Australia, commercialising through licensing, and replicating globally. The partnership with Himadri embodies this model. As Jordaan noted,“They weren’t chasing financial returns; they wanted to leverage our technology to transform their business, that’s what made it work.”

The 2025 licensing agreement grants Himadri exclusive manufacturing rights for India, with Sicona receiving gross-sales royalties while embedding its engineers to supervise quality control and governance. The deal structure allows Himadri to fund 100% of capital expenditure while Sicona maintains control over IP, product consistency, and global branding. It represents a capital-light commercialisation path for deep-tech scale-ups, one that mitigates financial risk without diluting strategic control.

Sicona’s timeline of execution demonstrates disciplined progression:

- 2019–2020 - Spin-out and seed funding; co-founder and CTO appointment; pilot design delayed by COVID-19.

- 2021–2022 - Technology validation through pilot-scale samples and customer testing.

- 2023 - $22 million Series A led by Himadri despite a global VC downturn.

- 2025 - Exclusive licensing and deepened partnership; customer engagements and pre-sales, engineers supporting in India for commercial build-out.

- 2028–2029 - Commercial production launch to supply Indian and European markets.

- 2030 - Expansion to the US (tariff-protected facility) and an Asia-Pacific hub – possibly Australia.

Impact & Results

Before the Himadri alliance, Sicona had raised roughly $28 million in seed and early-stage capital, operating a pilot-scale facility in Australia. The 2023–25 partnership boosted its capital base above $50 million, expanded engineering and customer-qualification capacity, and positioned the company as a global leader in solid-silicon anode technology. Sicona’s pilot lines continue to produce samples for multi-year OEM testing while its Indian facility moves toward commercial scale.

The partnership transforms both sides: Himadri secures a strategic pivot to high-value downstream battery materials, and Sicona achieves commercial proof of concept without heavy capital exposure. As Jordaan stated,“This deal proves you can scale deep tech without sinking under capex, if you find the right partner and design the governance right.”

By 2025, Sicona’s materials had been validated with global battery customers, and the India-based facility was under engineering design. The collaboration ensures co-branded production, royalty revenue, and shared access to qualified customers. Looking ahead to 2030, Sicona plans to establish three global manufacturing hubs: India (Europe + domestic supply), the United States (behind tariff walls), and Australia (Asia–Pacific exports) collectively addressing a US$ 10 billion global market.

Lessons & Insights

Supply-Chain Reinvention

By substituting solid silicon feedstocks for silane gas, Sicona bypassed a raw-material chokepoint monopolised by China.

Core Takeaway

Strategic innovation at the materials level can unlock geopolitical resilience and supply-chain autonomy.

Partner-Led Scale Without Capex Burden

Himadri’s full-funded model cut Sicona’s capital exposure while ensuring engineering control through embedded teams.

Core Takeaway

Partner-financed scale can accelerate commercialisation if IP, QC, and governance are tightly structured.

Capital Timing and Strategic Investors

Raising $22 million during a global VC downturn proved the importance of corporate investors with long-term horizons.

Core Takeaway

Strategic alignment outweighs valuation in deep-tech financing cycles.

Cross-Border Policy and Tax Learning

Navigating licensing taxes, withholding rules, and capital-flow controls highlighted trade-policy gaps. Jordaan noted the need for “carve-outs in free-trade agreements for technology licensing and smoother capital flows between Australia and India.”

Core Takeaway

Policy innovation must match technological innovation to unlock bilateral industrial growth.

Partnership & Cultural Fit

Trust and speed defined the relationship. As Jordaan summarised, “Finding a partner who’s entrepreneurial, not bureaucratic, makes all the difference, that’s what we found in Himadri.”

Core Takeaway

In India, progress travels at the speed of partnership, credibility is earned through relationships, not contracts.

By 2030, Sicona aims to operate three regional hubs, India, the US, and Australia, supplying electric-vehicle and grid-storage manufacturers across Europe, North America, and Asia. Its SiCx® technology, now validated at pilot scale, will move into full commercial production through the Himadri facility, establishing India as a key node in the global clean-energy supply chain.

As Jordaan puts it, “India is instrumental to our global growth plans, it’s the democratic version of the new China story.”

All information has been verified from primary company submissions, official filings, interview transcripts, and secondary materials cited in the References section.

Company Snapshot

KPI Impact Snapshot