Context & Opportunity

When a Pune-based engineering firm founded in 1990 set out to help global enterprises navigate digital change, few could have predicted its rise into one of the world’s fastest-growing IT services brands. Over three decades, Persistent Systems has evolved from a niche product-engineering partner into a global AI-first transformation leader, redefining how technology fuels business resilience. In Australia, its journey reflects precision strategy and patient localisation, shifting from behind-the-scenes engineering to a trusted transformation partner for ten of the ASX Top 30 companies.

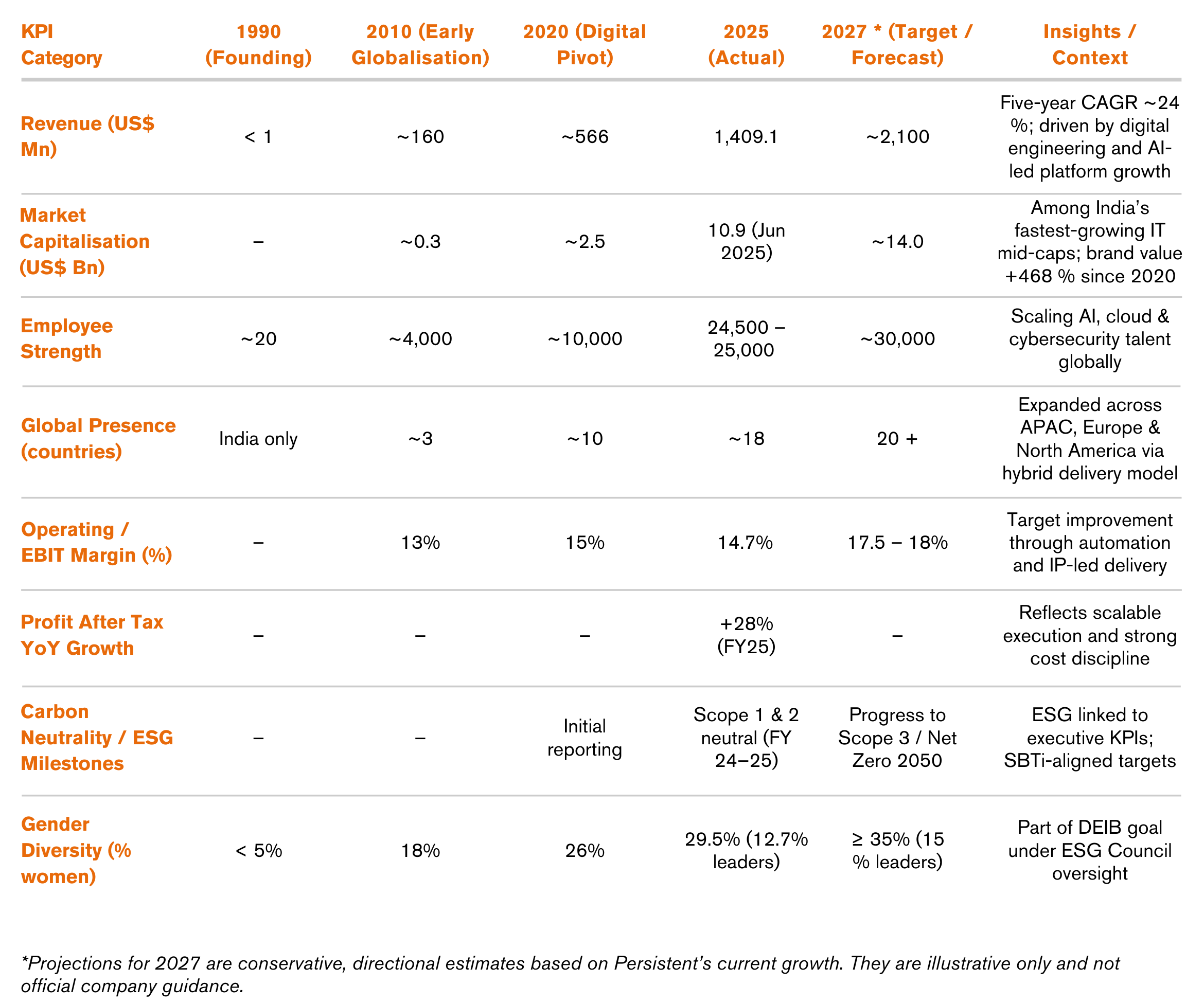

Founded by Dr Anand Deshpande with an initial capital of US$21,000, Persistent Systems is guided by its structured “Six-Orbit” growth strategy, systematically advancing from core product development to platform-driven, data-centric, and AI-enabled services. Its four-year Revenue CAGR of 25.6% between FY21 and FY25 underscores structural momentum driven by hyperscaler partnerships, IP-led productivity, and targeted acquisitions.

Persistent’s decision to enter the Australian market was driven by a convergence of strategic opportunity and cultural alignment. Australia’s mature technology ecosystem, demand for engineering-led innovation, and openness to global partnerships made it a natural extension of Persistent’s global footprint. The company established direct offices in Sydney, Melbourne, and Brisbane, selecting NSW and Victoria for their enterprise density, technology clusters, and skilled talent availability. Unlike many peers that relied on distribution partners, Persistent chose direct client engagement, enabling greater control, faster responsiveness, and long-term relationship building.

Strategy & Execution

From inception, Persistent has upheld an engineering-first culture, shaped by Dr Deshpande’s experience at Hewlett-Packard Labs, which instilled a product-centric innovation mindset that continues to define the company’s trajectory.

The Six-Orbit Framework articulates Persistent Systems’ deliberate path of organisational maturity and strategic evolution. The First Orbit (1990–2001) focused on foundational product development; the Second Orbit (2001–2008) consolidated leadership in outsourced product engineering; the Third Orbit (2008–2016) expanded capabilities to full product lifecycle and ventured into Big Data; the Fourth Orbit (2016–2019) marked entry into large-scale enterprise digital transformation; the Fifth Orbit (2019–2023) positioned the firm as a global leader in digital engineering; and the Sixth Orbit (2024 onward) drives AI-led growth and platform scalability, signalling a new phase of global integration and differentiation.

Persistent today positions itself as an AI-led, platform-centric digital-engineering partner, delivering an integrated portfolio across four domains. Digital Engineering Services anchor the business through end-to-end product development powered by AI platforms such as SASVA™ and GenAI Hub. Cloud and Infrastructure Modernisation drive multi-cloud transformation across AWS, Azure, and GCP, where Persistent is Strong Performer in the Gartner Peer Insights™ “Voice of the Customer” for Public Cloud IT Transformation Services (PCITS), January 2025. In AI and Data Analytics, platforms like iAURAand GenAI Hub enable automation, predictive intelligence, and measurable productivity gains.

Enterprise Modernisation supports large, regulated industries through application re-platforming and digital transformation, reinforcing Persistent’s reputation for complex, mission-critical delivery.

Initial operations in Australia centred on partner-led product engineering for identity-and-access-management platforms. While technically successful, this model limited Persistent’s visibility under larger hyperscaler umbrellas. Recognising this constraint, the company executed a strategic reboot, transitioning to direct enterprise engagements and expanding into cloud modernisation, AI and data analytics, low-code platforms, and customer-experience transformation. The result was a dramatic shift in brand perception, from backend support to challenger transformation leader.

"We realised the importance of owning the client relationship and building a direct brand presence in the market.

Persistent’s Australia–India operations are built on an integrated dual-market talent model. In India, campus programs and leadership tracks sustain engineering scale and innovation depth. In Australia, targeted local hiring and flexible work models attract senior domain specialists in BFSI, telecom, and healthcare. Persistent invested heavily in cross-cultural training, inclusive leadership, and shared rituals to bridge collaboration styles between Pune and Melbourne delivery hubs, fostering a culture of psychological safety, co-creation, and shared accountability that translates technical expertise into relationship-driven engagement, a hallmark of Australian business culture.

Persistent approached its Australian expansion with a long-term investment lens. Early capital was directed towards building delivery centres in Sydney and Melbourne, funding infrastructure, local compliance, and capability localisation. ROI was measured not only in revenue but in brand equity, talent success, and ecosystem integration. As operations matured, the focus shifted to cost efficiency through offshore–onshore delivery blending, automation, and standardisation, yielding stronger margins and sustained growth.

"Persistent operates with a boutique mindset, offering tailored services to large enterprises undergoing digital transformation."

Impact & Results

Persistent Systems has delivered sustained double-digit growth and rising profitability, underscoring disciplined execution and strategic clarity. In FY 2025, the company reported US$1.41 billion in revenue, an 18.8% year-on-year increase, with profit after tax of approximately US$168 million and EBIT margin of 14.7%, aspiring a further 200–300 bps expansion by FY 2027. Persistent has now recorded 22 consecutive quarters of sequential revenue growth, reflecting operational consistency, maintains a near-zero debt-to-equity ratio, providing strong balance-sheet flexibility.

As of September 2025, market capitalisation reached US$8.5 billion, consolidating its standing among India’s top digital-engineering firms.

Persistent’s performance has been validated by independent analyst recognition: Won multiple ISG Customer Experience (CX) Star Performer Awards based on the voice of its customers. The Company received ‘Growth Honor of the Year’ at Everest Group Elevate 2025. Persistent was cited as a Leader in all four quadrants of Digital Engineering (ISG 2025), Leader & Star Performer in Software Product Engineering (Everest 2024), and Strong Performer in the Gartner Peer Insights™ “Voice of the Customer” for Public Cloud IT Transformation Services (PCITS), January 2025. It also received Google Cloud’s 2025 APAC Partner of the Year for Infrastructure Modernisation.

Building on its AWS, Azure, and Google Cloud alliances, Persistent has developed a hyperscaler ecosystem that forms a cornerstone of its growth model. Partnerships with Salesforce, Snowflake, and OutSystems further extend platform reach and client integration capability, enabling co-innovation with global technology leaders and end-to-end enterprise transformation.

Persistent embeds ESG principles into every market expansion. Its Australia-registered subsidiary operates under a transparent compliance framework supported by EY’s global governance systems, quarterly audit reviews, and local legal partnerships. The company achieved carbon neutrality for Scopes 1 & 2 in FY 2024–25 and has pledged net-zero by 2050. Through the Persistent Foundation, the company has invested over US$12 million in community initiatives, impacting over 450,000 lives. Globally, 29.8% of its 26,000-plus workforce are women (12.7% in leadership), with a target of 35% by FY 2030. In Australia, initiatives such as women-in-tech hiring, renewable-energy sourcing, and STEM community partnerships reinforce its identity as a responsible corporate citizen aligned with both Indian and Australian ESG priorities.

Persistent’s consistent efforts towards enhancing its ESG efforts have been recognised by multiple leading rating agencies over the last few quarters, elevating it to the best rated amongst peers.Persistent has been included in the Dow Jones Sustainability World Index, with an impressive score of 85 this year, placing it amongst global leaders in sustainable business practices. Persistent has been rated AA on the latest MSCI ESG ratings, moving up from BBB, which is a jump of 2 levels in ranking. NSE Sustainability Ratings & Analytics Ltd has awarded Persistent an ESG rating of 77/100. SES ESG Research Private Limited has awarded Persistent an ESG score of 81.7/10.

While structurally well-positioned, Persistent faces headwinds common to high-growth digital firms, talent competition, macro-economic exposure, and client concentration. Yet its diversified vertical portfolio, recurring IP-revenue streams, and robust cash generation mitigate these risks. Management aspires US$2 billion in annual revenue by FY 2027 (19–20 % CAGR) and US$5 billion by FY 2031, with margin expansion expected through automation, offshore-mix optimisation, and IP-led monetisation.

The Australia–India Economic Cooperation and Trade Agreement (AI-ECTA) has further reduced friction in cross-border services, particularly through double-taxation resolution. Persistent has leveraged these provisions to deepen engagements in BFSI and telecom, secure multi-year managed-service contracts, and pilot next-generation Agentic AI and outcome-based models.

"AI-ECTA lowered barriers for coordinated India-ANZ delivery models and simplified vendor selection for Australian enterprises seeking offshore engineering partners.

Early dependence on partner-led delivery limited Persistent’s brand visibility and autonomy in Australia. The company recalibrated by owning client relationships and establishing a direct market presence, unlocking enterprise-scale engagements. Initial cultural misalignment between Indian and Australian teams was mitigated through cross-cultural leadership programs and a hub-and-spoke governance model balancing autonomy with consistency. These learnings now underpin Persistent’s broader global-market playbook.

Australia now serves as a strategic testbed for AI-first transformation, particularly in telecom, BFSI, and public services. Over the next five years, Persistent plans to quadruple revenue from Australia, expand its Melbourne Centre of Excellence for Cloud, Cybersecurity, and AI, and intensify local hiring and university partnerships. The company’s roadmap envisions Generative AI and Agentic AI solutions, ESG-linked innovation programs, and extended collaboration with hyperscalers for co-developed Australian IP, aligning with its global ambition to reach US$2 billion by FY 2027 and US$5 billion by FY 2031, cementing its position as the AI-led digital-engineering bridge between India and Australia.

Lessons & Insights

Market Entry & Strategy

Persistent’s entry into Australia reflected a long-term commitment to building proximity with clients in banking, healthcare, and government, sectors driving digital transformation in the region. Rather than pursuing scale-first expansion, it prioritised strategic partnersips and high-value engagements to establish credibility.

The company leveraged its proven India delivery model anchored in its “Six-Orbit” growth framework to integrate local presence with global capability, balancing responsiveness with efficiency.

Core Takeaway

Success in Australia depends on precision, not presence, entering with a focused sector strategy, investing in client intimacy, and leveraging existing global strengths to deliver local impact.

Regulatory & Policy Environment

Operating in Australia’s tightly regulated digital landscape especially in BFSI, health, and government required alignment with cybersecurity, data residency, and privacy frameworks.

Persistent treated compliance as an innovation enabler, embedding risk governance into its cloud, data, and AI offerings, an approach that resonated with risk-sensitive Australian clients.

Core Takeaway

In mature markets like Australia, compliance excellence is not a cost; it is a credential that builds trust and strengthens client stickiness.

Customer & Market Positioning

Persistent learned that Australian clients value co-creation and transparency over transactional delivery. Its positioning evolved from a technology vendor to a transformation partner, helping enterprises re-architect systems and modernise platforms with measurable ROI.

Hyperscaler partnerships with AWS, Microsoft, and Google Cloud deepened Persistent’s relevance, enabling joint solutions tailored to local enterprise needs and sustainability priorities.

Core Takeaway

In Australia’s relationship-driven market, partnership capital built on trust, transparency, and technical depth is the decisive differentiator.

Organisation & Capability Building

Persistent expanded its local leadership base and delivery teams in Australia, combining global delivery efficiency with regional client engagement. Targeted hiring in domain-heavy areas like healthcare analytics and financial platforms ensured contextual expertise.

Ongoing cross-border learning via talent mobility between India and Australia, enhanced both agility and cultural cohesion across teams.

Core Takeaway

Building regional capability requires hybrid teams, local leadership empowered by global knowledge flows to deliver contextual solutions at speed and scale.

Broader Lesson for Cross-Border Business

Persistent’s experience in Australia reinforced the importance of aligning global engineering excellence with local business nuance. Its disciplined approach, co-create, comply, and customise, helped build lasting client trust and brand equity.

The Australia–India corridor also became a testbed for next-generation delivery models blending onshore design, offshore scale, and near-real-time collaboration.

Core Takeaway

Cross-border success in advanced markets comes from combining India’s innovation depth with Australia’s regulatory credibility and client-centric culture, a model for the next era of digital partnerships.

All information has been verified from primary company submissions, official filings, interview transcripts, and secondary materials cited in the References section.

Company Snapshot

KPI Impact Snapshot