Abstract

The global rush for critical minerals has picked up pace considerably over the last 10 years. The shift to advanced and sophisticated technologies in industrial, defence, scientific and renewable applications integral to a country's future competitiveness and economic growth; regional and geopolitical supply chain risks; trade wars and economic uncertainty; thrust towards a green industrial revolution; and the most recent COVID-19 crisis explain the rush, which has accentuated due to global mineral dependency on China. In 2019, the Australian government released the 'Critical Minerals Strategy' which wanted to position the country as a "world powerhouse" in critical minerals.

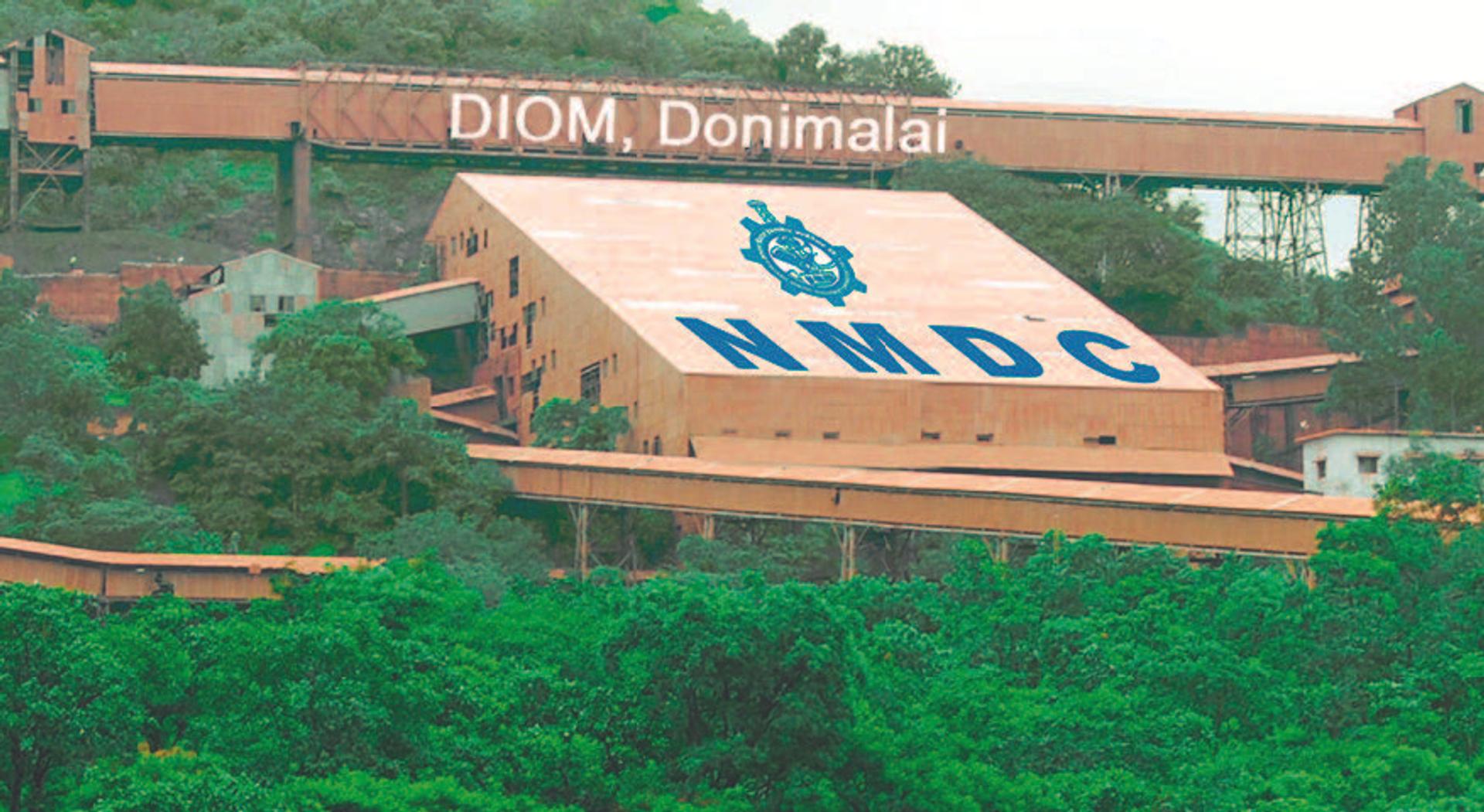

In June 2020, former Australian Prime Minister Scott Morrison and Indian Prime Minister Narendra Modi agreed to upgrade their countries' bilateral relationship to a Comprehensive Strategic Partnership (CSP). Both countries have signed a memorandum of understanding (MoU) that explores opportunities to increase trade, investment and research & development in critical minerals. This case study shares the journey of India's Public Sector Undertaking (PSU) National Mineral Development Corporation (NMDC) first overseas entry via acquisition of Australia's Legacy Iron Ore (ASX: LCY), and its latest strategy of exploring strategic minerals.

Introduction

Mining is a sector of strategic priority for Australia and India. Australia’s engagement with India in the resources sector has largely been led by three main trends – first, Australian resource exports to India (particularly metallurgical coal), also copper and gold, which makes the bulk of our merchandise trade, second, Indian direct investment into mining tenements – leases in Australia and Australian investment in Indian resource assets through partnerships and operations, and third, the competitive edge and role of Australian Mining Equipment and Technology Services Companies (METS) in modernising India’s mining sector. Beyond these three core pillars of Australia India resource engagement – both countries are now exploring ways to deepen their critical minerals engagement as part of the Critical Minerals MoU signed in 2020, as part of Australia India CSP.

NMDC Limited, a Navratna Indian public sector undertaking under the Ministry of Steel is primarily engaged in the business of exploring minerals and developing mines to produce raw materials. NMDC is one of India's largest resources companies and single largest iron ore producer with resources in excess of 1 billion tonnes of iron ore.

It has expanded its business through horizontal integration as well, in the fields of coal, rock phosphate, limestone, gold and diamonds, and diversified its activities in the field of renewable energy by setting up windmills in Karnataka, explored possibilities in solar energy and is keen to acquire more strategic mineral resources globally. Recently NMDC commissioned a 3 MTPA Steel Plant in Chhattisgarh as a part of its strategy of vertical integration in the iron ore supply-chain.

NMDC’s first overseas acquisition began in 2011 with an initial 50 percent stake in ASX-listed Perth based Australian iron ore, gold, and base metals exploration company, Legacy Iron Ore Limited (Legacy). NMDC, as a cornerstone investor, paid A$19 million with an intent of furthering its strategic interests in the natural resources sector globally. NMDC in subsequent years has gradually increased its equity stake in Legacy from 50 percent to 76 percent, and now has 90 percent stake with right issues.

Legacy (ASX: LCY) founded in 2007, is primarily an iron ore exploration company with a diverse portfolio of assets spanning gold, base metals, and tungsten. Legacy has numerous promising projects in Western Australia encompassing 24 tenements in known mineralised belts and is advancing the projects into higher stages of exploration, with its present focus the development of its gold assets in the Eastern Goldfields, including Mt Celia Project.

Legacy is also in a joint venture with Hawthorn Resources Limited (Hawthorn) and Hancock Magnetite Holdings Pty Ltd (Hancock) on the

Mt Bevan Project, north of Kalgoorlie in Western Australia, where the company is progressing a potentially world class magnetite project and exploring for nickel-copper mineralisation at an early stage, whilst East Kimberly projects have potential for hosting VHMS base metal, gold, rare earths and tungsten mineralisation.

Legacy has signed a joint venture agreement in April 2022, with Hancock Magnetite Holdings Pty Ltd, a subsidiary of Hancock Prospecting Pty Ltd in relation to the Mt Bevan magnetite project. By investing $9 million, Hancock earned a 30 percent stake in the iron ore project which can then be increased by funding a pre-feasibility study (PFS), which is currently under progress and scheduled to be completed by December 2023. It is funding the pre-feasibility study, with Atlas Iron – owned by Hancock – as the manager of the joint venture.

If and when the PFS is completed, Hancock will hold a majority 51 percent in Mt Bevan, Legacy will own 29.4 percent and Hawthorn will hold the remaining 19.6 percent. Mt Bevan could be a $5 billion development, with the magnetite used as an input in Indian steel mills.

Legacy also signed a joint venture agreement with Hancock in June 2023, for the other minerals (particularly Lithium, Nickel / Copper) in the Mt. Bevan tenement. As per the terms of the agreement, Hancock would be investing in Lithium exploration in the tenement in various stages and would be investing approx. $26 M to fund the project up to PFS level depending upon the success of previous stages of exploration.

Australia Strategy

NMDC kept the size of its first overseas acquisition small to ensure that its first international foray is swift and straight forward. For a state-owned company like NMDC, a high-profile billion-dollar acquisition would have invited greater scrutiny and delays.

NMDC found investing in Legacy was an ideal entry point in the Australian market. It was driven by its belief in Australia's reputation as a "very favourable" place to invest, which is not dented by the combination of a carbon tax, mining tax and escalating labour costs, and the political stability it offered.

For Legacy, NMDC's fund infusion, presence and financial muscle meant an opportunity for them, to acquire new mineral projects and grow. Legacy is also actively exploring various commodities like gold, base metals, tungsten & Lithium in WA. It is also aggressively looking to acquire some early exploration assets of Lithium and planning to start gold mining activities in one of its projects located in the South Laverton area.

“NMDC chose to invest in Australia as it offers wonderful opportunities to acquire and develop mineral assets. The Australian government supports foreign investment and policies are investor friendly. WA state is endowed with the minerals, huge exploration, and mining industries.” – Rakesh Gupta, CEO, Legacy Iron Ore Limited

“The Australian state of Western Australia has become the new top destination for mining investment, overtaking Nevada to claim first place, according to Canada’s Fraser Institute.”

“This year’s Annual Survey of Mining Companies ranks 84 jurisdictions around the world based on geologic attractiveness

(minerals and metals), and government policies that encourage or deter exploration and investment. Western Australia, which accounts for about 37 percent of the world’s iron ore production, moved up from fourth place in 2020 to lead the 2021 list.”

“All business deals are done honestly and are 100% transparent in Australia. Specifically, in mineral sectors, technology, skilled manpower and resources are available to support the development journey.”

“We would be able to export our products, mineral to India with reduced tax burden. We will go for a bigger campaign and will try to get more developed resources so that we may reduce the construction period.”

NMDC has invested close to AU$40 million in its subsidiary, Legacy since its acquisition in 2011.

Seeing The Future

Building technological capabilities and infrastructure investment are key components of India’s aspiration to become a US$5 trillion economy by 2024. India’s transition to Industry 4.0 and future industry competitiveness (led by automation, robotics, digital applications, advanced manufacturing and sophisticated applications) requires a new mineral mix with supply chain resilience and reliability. Key industries relying on critical minerals include telecommunications, electronics, energy, healthcare, defence, aerospace, and transportation. Goals like Zero Emission vehicle market and adding 450 GW of renewable capacity by 2030 will require a sustained and secured supply of critical minerals. The EV battery industry has the potential of becoming a US $300 billion industry in the coming 12 years. Most lithium-ion batteries also require cobalt and graphite, used in retaining and discharging electricity.

Australia is one of the leading producers of lithium. Due to lack of resources, India is among the top 10 importers of the metal in the world. Australia can help India achieve this resource supply and security. The collaboration with Australia fits well, also with the Indian government’s recent international exploration program, (Khanij Bidesh India Ltd [KABIL], a joint venture formed between three state-run companies – National Aluminium Co, Hindustan Copper Ltd and Mineral Exploration Corp), for acquiring lithium, nickel, cobalt and rare earth mines overseas to address growing demands in the domestic market. NMDC’s strategy in Australia, offers a successful reference point.

Planning Ahead

NMDC is actively pursuing the acquisition of overseas strategic mineral assets with the objective of meeting its own requirements and towards raw material security for the country's steel and fertilizer industries. After successful acquisition of Legacy, NMDC is trying for more acquisitions in Brazil, Mozambique, Russia, USA and South Africa. Some key takeaways from this case study are –

- Have a strategic vision for this sector, shed silo-centric approach and have a more coherent, converging and multistakeholder engagement strategy that enables project development swiftly

- Acknowledge that complex value chains, high levels of monopoly, distortive government interventions make critical minerals very different than the mature commodity sectors - such as oil, gas, coal, or iron ore

- Indian PSUs need to interact with private players abroad more frequently and with full autonomy, instead of limiting themselves to just foreign government entities

- India needs to be proactive in sourcing and securing critical minerals supplies from Australia, strategic acquisition of mines needs to be sped up

- Australia India engagement in the critical minerals space will also depend on our ability to align our strengths, our complementarities - so aligning Australia's resource capacity and capabilities and its depth of experience in technology, regulation, operations, markets, or sustainability with India's manufacturing potential and commercial led innovation opportunities. So, exploring a whole-of-value chain perspective that promotes the development of upstream extraction, midstream processing, and downstream manufacturing.

The Indian Critical Minerals Strategy has identified 49 minerals which will be vital for India's future economic growth. Initiatives such as the National Electric Mobility Mission plan 2020, has a projection of getting 6-7 million electric vehicles on Indian roads by 2030. Technology availability, risk appetite, access to capital are factors that will define the bilateral engagement in this space. Indian government and companies must move much faster if they are to fulfill India's aspirations, and progress must be measured based on outcomes rather than activity.

"We are happy that we chose Australia as preferred destination for the acquisition of mineral assets and we are looking for more assets here to meet the growing demand of critical minerals like Lithium, cobalt etc."