"We deliberately chose not to take a tactical or short-term approach; instead, the focus was on establishing a long-term strategy for the region and invest upfront with a clear, enduring vision for Australia."

Context & Opportunity

The trajectory of Hexaware Technologies is inseparable from the rise of India’s IT and BPM revolution. In the early 1990s, as India liberalised its economy and globalised its talent base, a new wave of technology-first enterprises emerged, laying the foundation for the country’s emergence as the world’s back-office and digital innovation hub. This ecosystem, initially built on cost arbitrage and talent scale, rapidly matured into a sophisticated, value-driven industry.

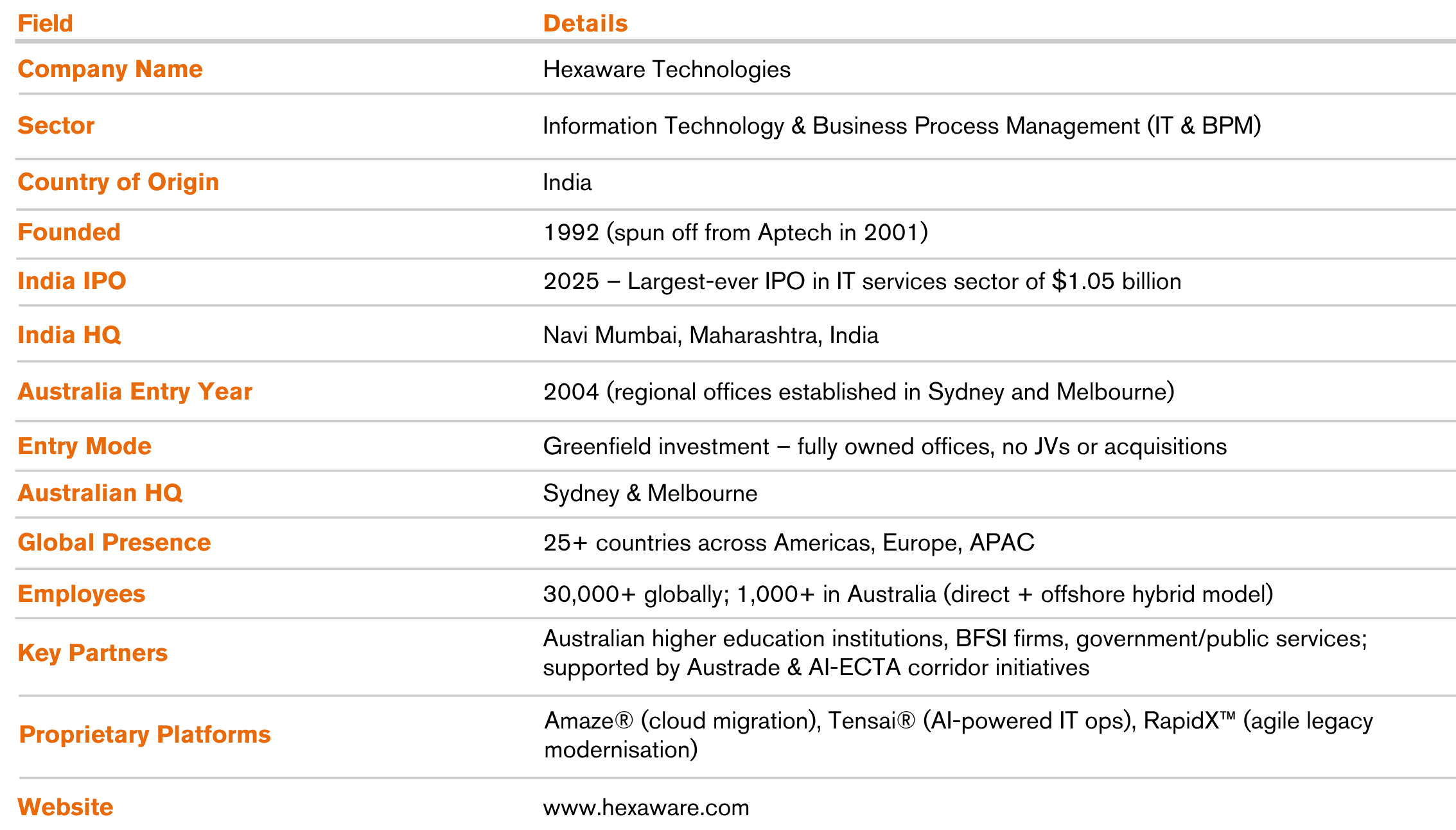

By FY2024, India’s IT industry had matured into a global force, with public listings by peers such as Wipro (1990), Infosys (NASDAQ, 1999), and TCS (2004) marking key milestones in the sector’s credibility and scale. Hexaware Technologies, founded in 1992 as part of Aptech and later spun off in 2001, was part of the same wave. With a strategic focus on cloud transformation, automation, and customer experience, Hexaware built a leaner, more agile, enterprise-grade platform serving clients in 25+ countries. On February 19, 2025, it joined its peers at centre stage by launching India’s largest-ever IPO in the IT Services sector at $1.05 billion. This not only validated Hexaware’s strategy and scalability but also cemented its emergence as a formidable next-generation player in India’s IT legacy.

Since 2014, under CEO R. Srikrishna, Hexaware has pursued a three-pronged strategy: Automate Everything, Cloudify Everything, and Transform Customer Experiences. Over the years, this practical playbook, shaped through deep work in cloud and automation, has matured into an AI-first operating model that Hexaware defines as AI-led, and human intelligence perfected.

When Hexaware Technologies chose to expand into Australia in 2004, the market was at a tipping point. Cloud computing, automation, and a shortage of competent workers, particularly in data science, cybersecurity, and artificial intelligence, all contributed to an increase in Australia's digital economy. Australia also faces a widening digital skills gap, projected to require over 1.3 million tech workers by 2030, opening opportunities for firms with offshore talent capabilities like Hexaware

Hexaware deliberately built offices in Melbourne and Sydney, focusing on promising areas such as banking, insurance, and universities. This move enabled Hexaware to grow its local significance, create jobs, and assure the long-term viability of its presence.

Strategy & Execution

Hexaware’s foray into the region is not transactional. It is strategic and long-term, informed by global ambitions, local congruence, and macroeconomic drivers. The company chose a Greenfield entrance approach, creating completely owned offices in Sydney and Melbourne while avoiding joint ventures or acquisitions. This decision highlighted Hexaware's desire to build brand equity, maintain delivery oversight, and integrate into the local ecosystem with a complete service presence.

Government support through AI-ECTA (2022) proved to be a critical facilitator. The trade agreement eliminated service delivery friction by allowing zero-duty access and facilitating skilled talent migration. The corporation also profited from India's "Make in India" digital initiative, which maintained a consistent innovation flow from its offshore operations.

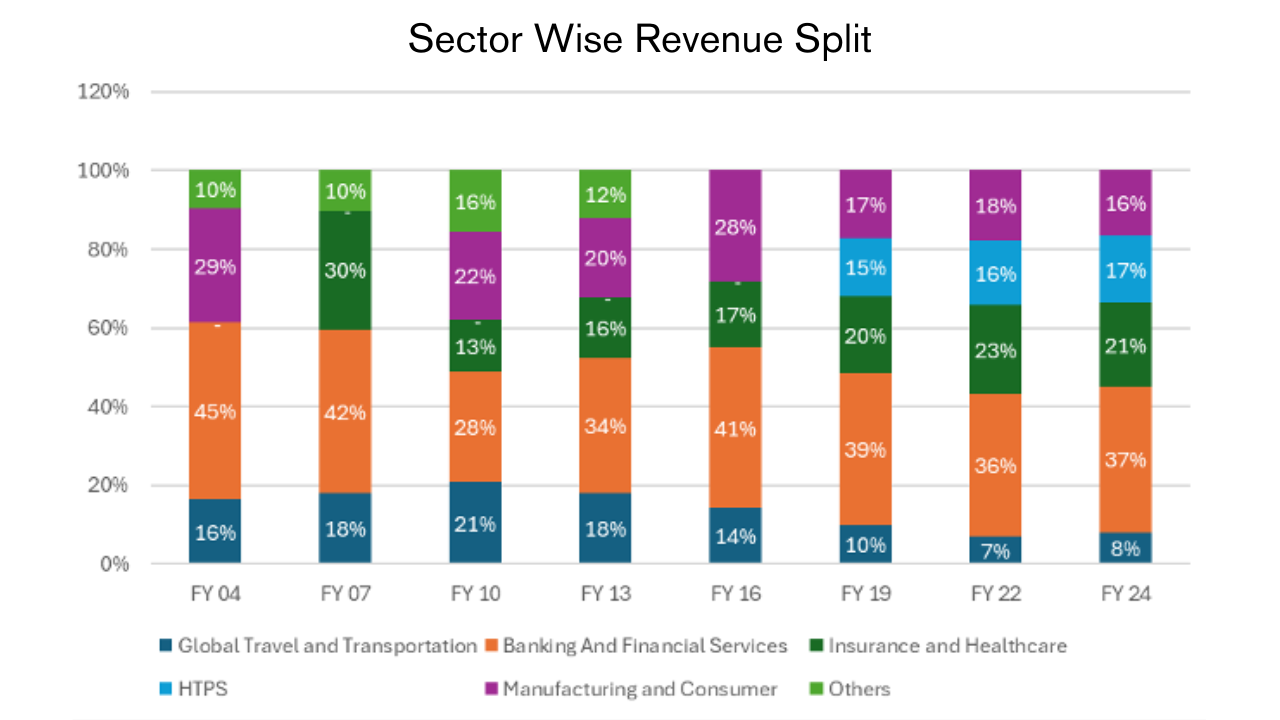

One of Hexaware's earliest and most daring wagers was to enter with full ownership and long-term investment, an unusual strategy in a risk-averse, relatively saturated IT market. Another brave decision was its sector-specific sequencing, which began with higher education, where there was a strong appetite for transformation, and then expanded to BFSI, Retail, and Manufacturing & Consumer.. The company also focused on developing IP and automation-first systems, allowing for faster deployment and measurable results.

Importantly, Hexaware's strategy focused on creating trust through local relationships, consistent branding, and striking the correct balance between global capabilities and regional adaptation. This method not only enabled the corporation to scale sustainably in Australia but also served as a model for future corridor expansions.

"Our approach in Australia and India has proven that blending local leadership with global capabilities drives superior client outcomes and operational agility.

Hexaware's growth in Australia occurred in stages, beginning with its entry in the mid-2000s, which targeted the higher education industry and leveraged its Oracle platform knowledge. By the late 2010s, it had expanded into banking, insurance, and retail in response to digital transformation surges. COVID-19 acted as a catalyst, forcing Hexaware to quickly implement remote and hybrid models, alter service delivery for regulated clients, and recalibrate its GTM strategy.

Hexaware's localisation activities were substantial. In terms of talent acquisition, it used a two-pronged strategy: build local delivery and account teams while supplementing them with offshore knowledge from India. Hexaware merged local geo-leaders in Australia, responsible for market growth and client relationships, with industry-focused delivery teams in India, and supported the model with cultural-alignment programs and adaptive work models to ensure smooth handoffs and operational excellence across borders.

Hexaware developed bespoke outcome-based pricing and packaging strategies to mitigate perceived risk in Australia's cautious IT procurement environment.

The solutions were modular, allowing clients to progressively increase adoption. The branding strategy was built on relationship marketing, including regional campaigns, thought leadership, and success stories from Australian industries such as higher education and BFSI. Hexaware maintained a steady talent pipeline by collaborating with Indian colleges and maximising immigration help, which was aided by provisions in AI-ECTA.

Hexaware's proprietary technology platforms, which include Amaze® for cloud migration, Tensai® for AI-powered IT operations, and RapidX™ for agile legacy modernisation, provide a significant competitive advantage. These were critical in enabling Australian clients to quickly and economically update old systems.

The corporation distinguished itself with its ESG strategy, which includes initiatives such as the "Rising W@H" campaign to reduce the gender gap in technology, urban afforestation, and the installation of solar energy on its campuses. These programs complemented Australia's rising emphasis on Environmental, Social, and Governance (ESG) issues, particularly in the public and higher education sectors.

Impact & Results

Hexaware's expansion into Australia had a substantial impact on financial, talent, trade, ESG, and strategic dimensions, helping the company, the market, and the larger India-Australia corridor

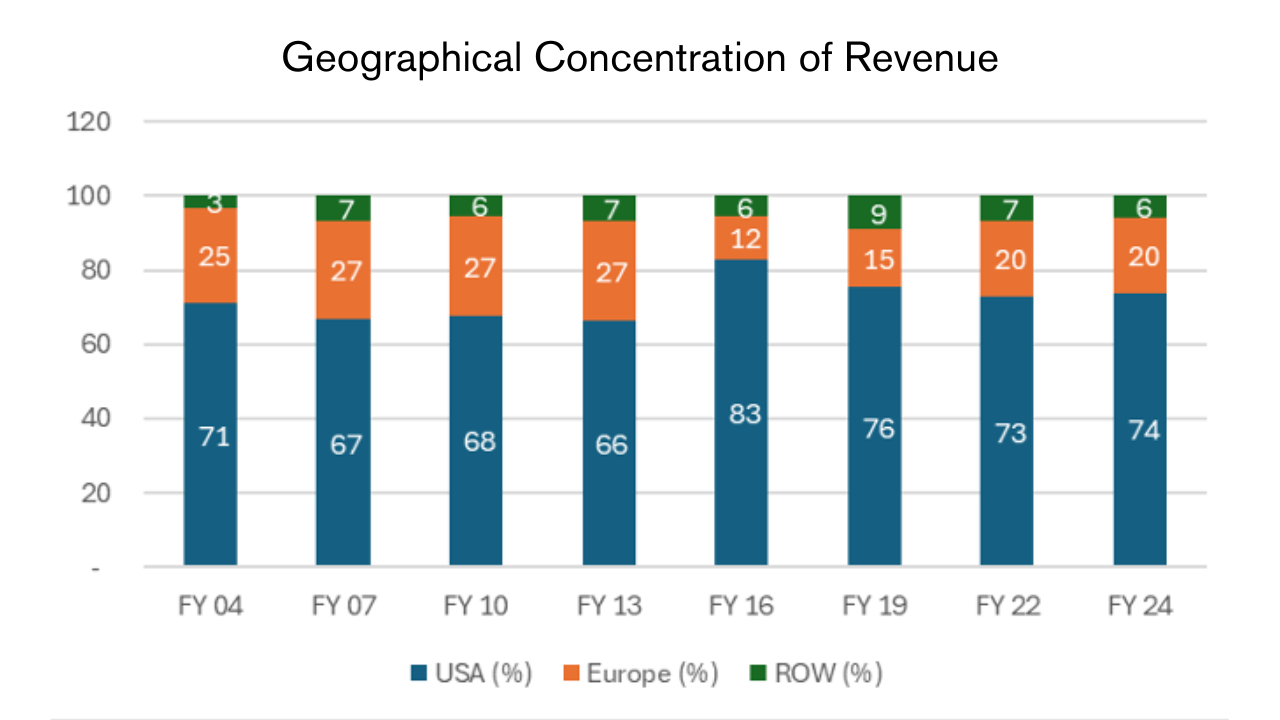

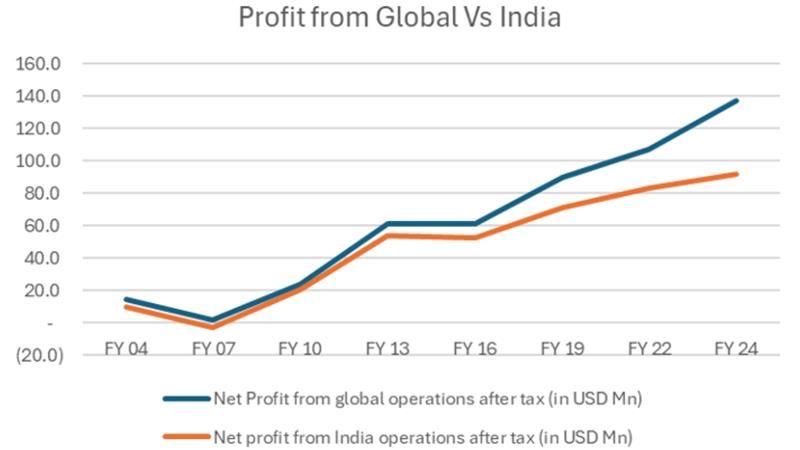

On the financial front, Hexaware generated $1,429 million in global revenue in CY2024, representing a 13.7% year-on-year increase, and carried that momentum into Q1 CY2025, with $371.5 million in revenue, up 12.4% YoY. As part of Hexaware's overall aim to reduce its previous reliance on the US market and diversify its revenue base across locations, Australia has emerged as a significant contributor, owing to solid customer wins in higher education, banking, and insurance.

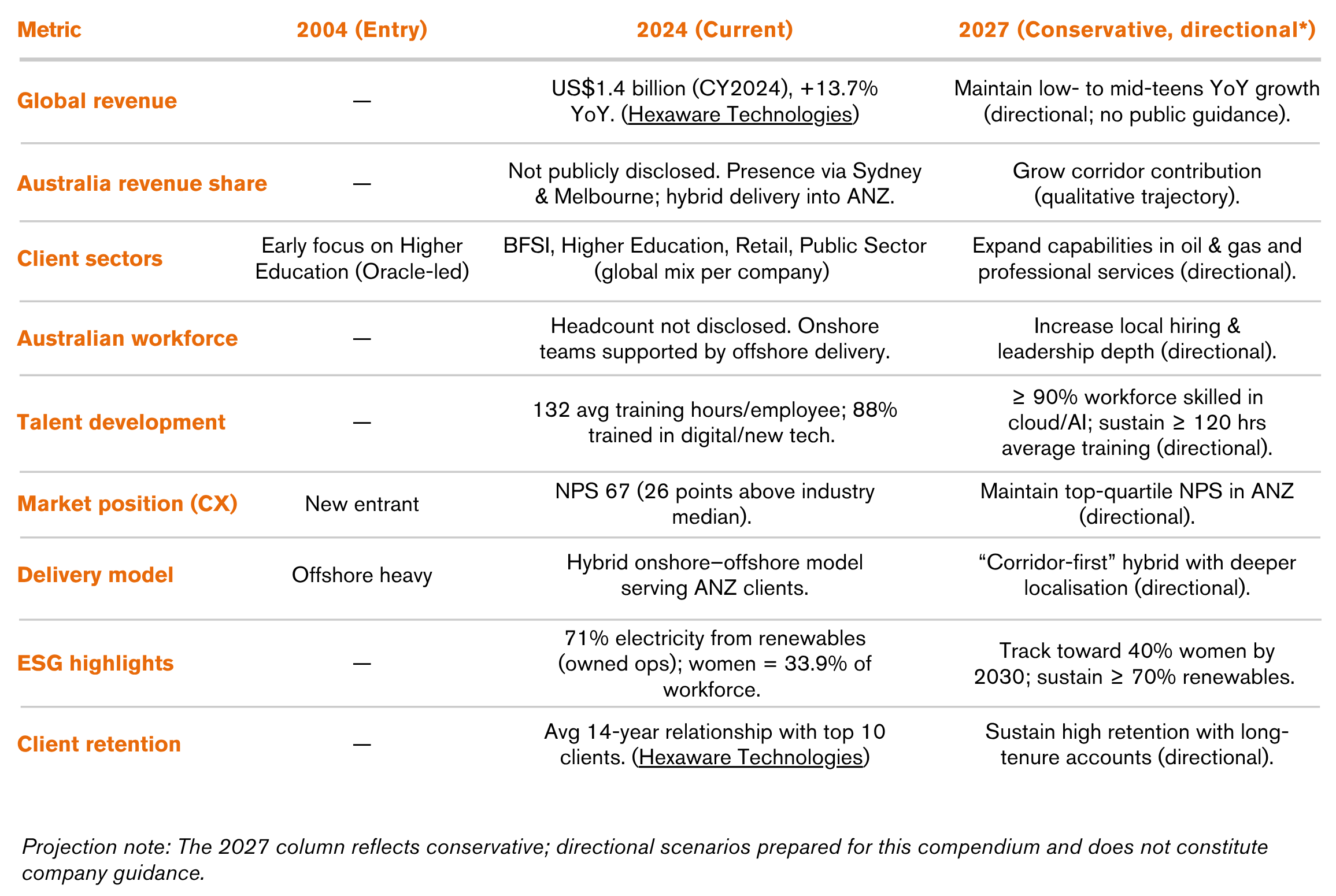

This move is consistent with the company's increasing geographic presence, as evidenced by the gradual increase in revenue share from the 'Rest of World' division (from 6% in FY04 to 9% in FY22). Using outcome-based pricing models and digital IP platforms such as Amaze, Rapid, and Tensai has helped to cut service costs and accelerate project launches in these emerging regions.

On the talent front, Hexaware adopted a hybrid onshore-offshore approach. In Australia, it established local jobs through delivery centres in Sydney and Melbourne while supplementing them with Indian expertise. As part of its workforce development strategy, more than 78% of IT personnel were trained in GenAI, and the company achieved an average of 132.83 hours of training per employee worldwide.

Supported by AI-ECTA, zero-duty service access and eased mobility provisions enabled faster deployment of Indian technical teams to Australian projects, helping expand bilateral services trade.

In terms of ESG effect, Hexaware has planted almost 5,000 trees, rehabilitated eight bodies of water, and installed 1,841 kW of solar power. It received 57.5% of its energy from renewables, had no data breaches, and had 33.9% female staff representation.

Strategically, Australia has emerged as a regional hub, with plans to expand into New Zealand and Western Australia, showcasing Hexaware's concept for corridor-driven growth. Other companies can measure success using KPIs such as NPS (Hexaware's 67 vs. industry median 41.2), client retention (15-year average), and regional employment contributions. Hexaware has not only expanded capabilities, but has also influenced norms in digital transformation delivery, cross-border workforce models, and resilient service operations in Australia.

Lessons & Insights

Market Entry & Strategy

Entered Australia through a Greenfield approach, establishing fully owned offices in Sydney and Melbourne rather than relying on joint ventures or acquisitions.

Sequenced expansion, which started with higher education, later expanding into BFSI, retail, and public services.

Core Takeaway

A sector-focused, phased entry builds credibility and accelerates trust in risk-averse markets.

Localisation & Talent

Balanced offshore scale with local hiring by creating delivery teams in Australia while leveraging India’s talent depth.

Invested in cultural alignment, adaptive work models, and regional recruitment to strengthen client engagement.

Core Takeaway

A hybrid delivery model succeeds only when local teams are empowered to own relationships and outcomes.

Customer Engagement & Commercial Model

Introduced outcome-based pricing and modular offerings to reduce procurement risk and enable progressive adoption.

Built brand equity through thought leadership, industry case studies, and relationship-led marketing.

Core Takeaway

In mature markets, differentiation comes less from cost and more from confidence in outcomes and delivery assurance.

Technology & IP

Proprietary platforms such as Amaze® (cloud migration), RapidX™ (agile modernisation), and Tensai® (AI-led IT ops) gave Hexaware a distinct competitive edge.

Accelerated client transformation journeys by combining automation-first systems with measurable efficiency gains.

Core Takeaway

IP-driven solutions provide leverage in markets where traditional cost arbitrage is commoditised.

Regulatory & Compliance Navigation

Addressed Australia’s compliance-heavy environment, especially data privacy and workforce mobility, by embedding local compliance officers and creating a specialised immigration support team.

Core Takeaway

Regulatory complexity must be treated as a core capability, not a back-office function.

ESG & Cultural Relevance

Differentiated through ESG initiatives aligned with Australian priorities: gender equity (Rising W@H), urban afforestation, and renewable energy adoption.

Core Takeaway

ESG leadership can strengthen credibility and resonance in markets with rising social and environmental scrutiny.

Resilience & Agility

COVID-19 exposed risks of an offshore-heavy model; Hexaware responded by rapidly adopting hybrid delivery and scaling cloud/automation.

Core Takeaway

Market shocks are accelerators, firms that pivot quickly can emerge more resilient and trusted.

Broader Lesson for Cross-Border Business

Hexaware’s expansion highlights the importance of local-first execution, IP-led differentiation, and corridor leverage (AI-ECTA).

Success was shaped less by replicating Indian strengths, and more by aligning with Australian client expectations and regulatory context.

Core Takeaway

In advanced markets, trust, compliance, and value creation, not just scale, are the foundations for long-term relevance.

"Our goal is to double our footprint in the region, both in terms of industry reach and market share.

All information has been verified from primary company submissions, official filings, interview transcripts, and secondary materials cited in the References section.

Company Snapshot

KPI Impact Snapshot