Context & Opportunity

Givvable is an Australian ESG technology platform transforming how organisations assess and manage supplier sustainability. Founded by sisters Naomi Vowels and Frances Atkins, the company automates supplier due diligence by scanning over 2,500 verified data sources to map more than 8 million global suppliers against ESG indicators and UN Sustainable Development Goals (SDGs). Its mission is simple yet ambitious, to make sustainability due diligence as standard and seamless as financial or legal screening.

The opportunity in India aligns perfectly with this vision. The country’s new BRSR Core framework, effective FY 2025, mandates deeper supply-chain ESG disclosure, while national priorities from renewable energy and critical minerals to circular economy policies signal a structural shift toward sustainable production. At the same time, Australia’s 2025 Trade Plan highlights India as a priority market for green technology collaboration, underpinned by tariff-free access via AI-ECTA.

For Givvable, these converging forces present a dual-sided opportunity to serve Indian corporates under growing regulatory pressure, and to provide Australian exporters with an ESG-ready ecosystem of verified suppliers.

As Naomi Vowels explains, “Companies now need to understand who they’re dealing with from a sustainability perspective. It’s not just compliance anymore; it’s alignment of values and goals.”

Strategy & Execution

Givvable’s journey from concept to scale was rooted in careful validation before build. Between 2019 and 2020, the founders conducted over 230 stakeholder interviews, developing clickable prototypes and pilots before committing code. The final product launched in 2021, co-designed with an anchor corporate client to ensure that every feature addressed real-world procurement pain points.

The platform’s value proposition lies in automating what used to be manual: bulk ESG screening, supplier evaluation, and instant data visualisation. Each supplier’s credentials, certifications, assessments, and ratings are algorithmically mapped to ESG themes and SDGs, enabling procurement teams to evaluate alignment without needing deep sustainability expertise.

Givvable’s Asia–Pacific expansion followed client supply chains. As Vowels notes, “Our clients are often headquartered in Australia, but their suppliers sit in Asia in countries like India, China, or Vietnam. We go where our customers’ ecosystems go.”

India emerged naturally within this network, with early clients such as Airtel (through Singtel-Optus partnership) and AB InBev India, both driven by global ESG mandates.

Entry into India combined relationship-led engagement with flexible commercial models. The company tested paid pilots and discounted first-year pricing to encourage adoption in a price-sensitive environment, while also providing free limited trials to demonstrate value on clients’ own supplier datasets. This “show-then-scale” approach helped overcome abstract perceptions of ESG data by making the results tangible to procurement heads.

Strategically, Givvable built regional supplier databases spanning India, Singapore, Philippines and Malaysia to localise data coverage. Its supplier portal allows SMEs often the hardest to map to submit information verified against primary sources. This dual mechanism bridges the visibility gap between large corporates and underserved small suppliers, creating the region’s most comprehensive sustainability graph.

Commercially, Givvable operates on an annual SaaS subscription model, integrating its data into ERP and e-procurement systems. As Vowels explains, “Most clients start with our standalone platform. Once they renew, they want to pull the data directly into their ERP. That’s when integrations start to scale.”

Impact & Results

Givvable’s impact is visible across three dimensions; operational efficiency, ESG performance, and ecosystem transformation, cementing its role as one of the most influential sustainability intelligence platforms to emerge from Australia. At the core, the platform’s ability to automate supplier due diligence has delivered measurable efficiency gains. Clients report up to 85% cost savings and 90% reductions in time spent on supplier data surveillance, effectively transforming a process that once took months into one that delivers near-instant results. This automation is not merely about speed, it enables procurement teams to reallocate resources from data collection to strategic supplier engagement, turning sustainability screening from a compliance burden into a value driver.

At scale, Givvable has aggregated over eight million suppliers globally, creating one of the largest ESG supplier databases in the world. By aggregating more than 2,500 verified data sources, it gives organisations real-time visibility into supplier credentials and their alignment with more than 200 ESG indicators and the UN Sustainable Development Goals (SDGs). This has allowed sustainable, social, and circular suppliers to gain visibility with corporate procurement teams, embedding sustainability directly into purchasing decisions. The result is a measurable uplift in both procurement transparency and corporate ESG reporting quality.

Beyond efficiency, Givvable’s platform has generated substantial social and environmental dividends. It actively promotes the inclusion of women-led, minority-owned, and disability-owned enterprises, enabling large corporations to strengthen diversity across their supply chains. By continuously tracking supplier certifications, policies, and environmental data, Givvable also minimises the risk of greenwashing, giving businesses confidence that their sourcing decisions stand up to audit scrutiny. The company’s datasets are increasingly being used to support green financing eligibility, ESG-linked trade compliance, and supply-chain due diligence for multinational clients operating across India, Southeast Asia, and ANZ.

Perhaps most importantly, Givvable has become a strategic enabler of the sustainability ecosystem itself. Its intelligence layer is now integrated into climate reporting frameworks and corporate sustainability dashboards across multiple jurisdictions, aligning with regulatory shifts in India, Singapore, and Australia. The platform’s capabilities have also extended to high-profile initiatives such as those linked to Australia-Singapore Green Economy Agreement, where it contributes to modelling sustainable procurement practices. Givvable’s success is not measured solely in revenue or users but in its influence, reshaping how businesses define, measure, and deliver responsible sourcing at scale.

Lessons & Insights

Market Entry & Validation

Entered India through anchor client relationships (Airtel via Singtel–Optus; AB InBev India via direct commercial contract).

Used paid pilots and trials to prove tangible value before scale.

Core Takeaway

In nascent ESG markets, early credibility is earned through results, not rhetoric, pilot proof drives pipeline growth.

Localisation & Flexibility

Adapted delivery formats and pricing to India’s cost-sensitive environment.

Built region-specific supplier databases to localise data authenticity.

Core Takeaway

Local responsiveness, not uniformity determines traction in multi-jurisdictional ESG markets.

Technology & Product Strategy

Built platform post-validation, ensuring every feature solved a confirmed client problem.

Aggregated 2,500+ data sources with mapping to UN SDGs for universal relevance.

Core Takeaway

Designing for interoperability across regulatory regimes ensures scalability beyond compliance cycles.

Trust & Relationship Building

Relied on Austrade, CSIRO, and DFAT linkages for introductions through Rise Accelerator.

Prioritised physical presence and relationship cultivation. As Vowels summarised, “People want to see you. They want to build a relationship before they go any further.”

Core Takeaway

In India, credibility grows through consistent engagement and ecosystem participation.

Organisational & Market Learning

Early years focused on educating clients rather than selling, a long-term investment that is now paying off.

Resilience and clarity of mission helped navigate skepticism. “We had people tell us no one cares about supplier sustainability; those same people are now our clients.”

Core Takeaway

Market education is a strategic investment; thought leadership precedes revenue leadership.

Over the next five years, Givvable aims to deepen ESG data integration globally and embed its datasets within mainstream procurement and finance ecosystems. Expansion is already underway in Europe, the UK, and North America, while Asia remains its fastest-growing region. The company plans to scale through partnerships with ERP, banking, and e-procurement platforms, positioning its intelligence layer as the default ESG data standard.

As Naomi Vowels notes, “As regulations tighten and corporate demand accelerates, we see a clear runway to become the global standard in sustainable procurement data.”

All information has been verified from primary company submissions, official filings, interview transcripts, and secondary materials cited in the References section.

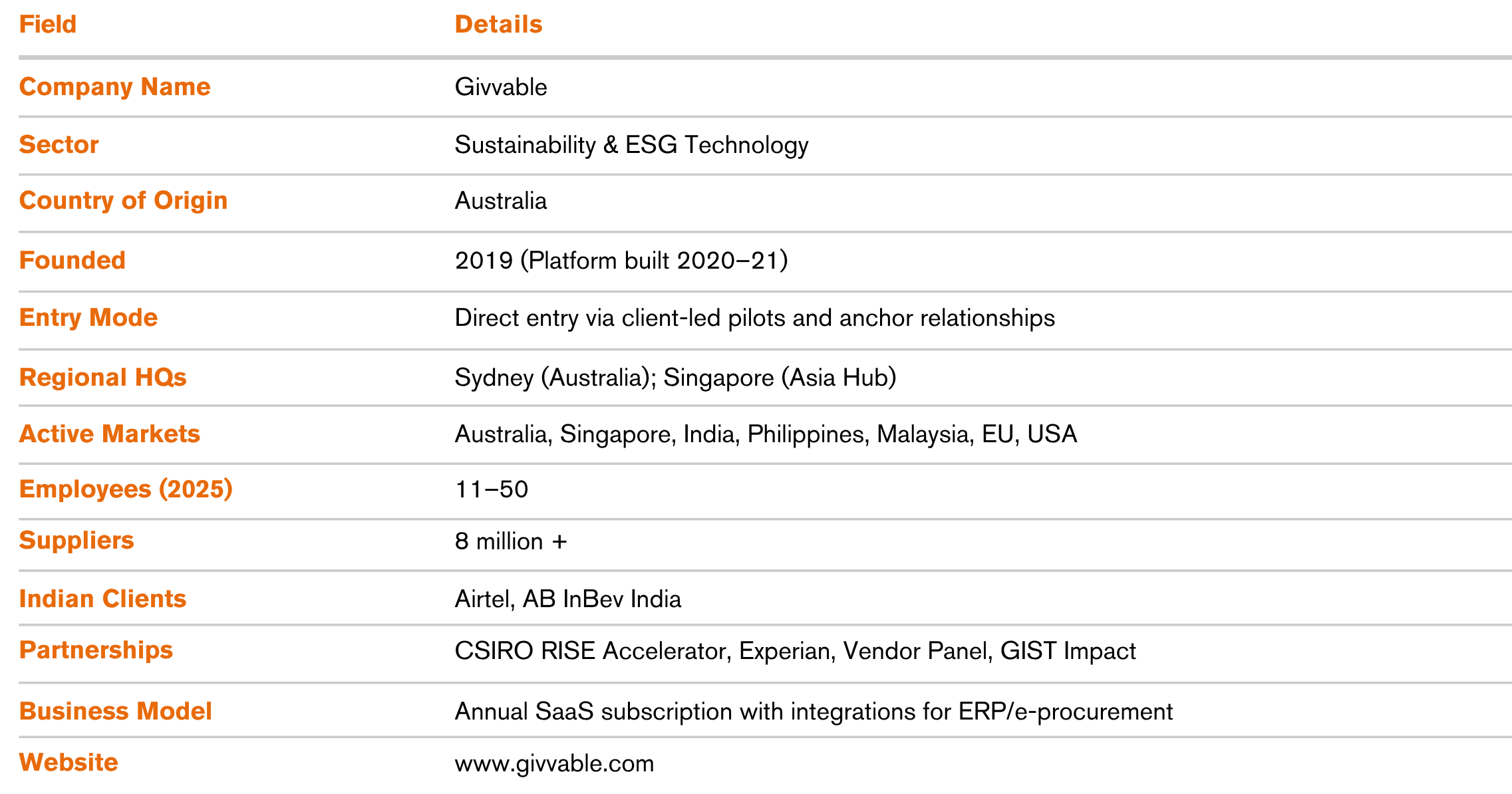

Company Snapshot

KPI Impact Snapshot