Abstract

Established in 1992, Ferra Engineering (Ferra), a global aerospace and defence company, specialises in the design, manufacture, and maintenance of subsystems and structures for the commercial and military aviation sectors. Ferra is recognised as an industry leader for advanced component manufacturing and complete turnkey project management solutions. Ferra has partnered with Original Equipment Manufacturers (OEM) such as Boeing, Lockheed Martin, Northrop Grumman, Airbus, GE Aviation, and Thales to provide manufacturing solutions to key strategic platforms and programs.

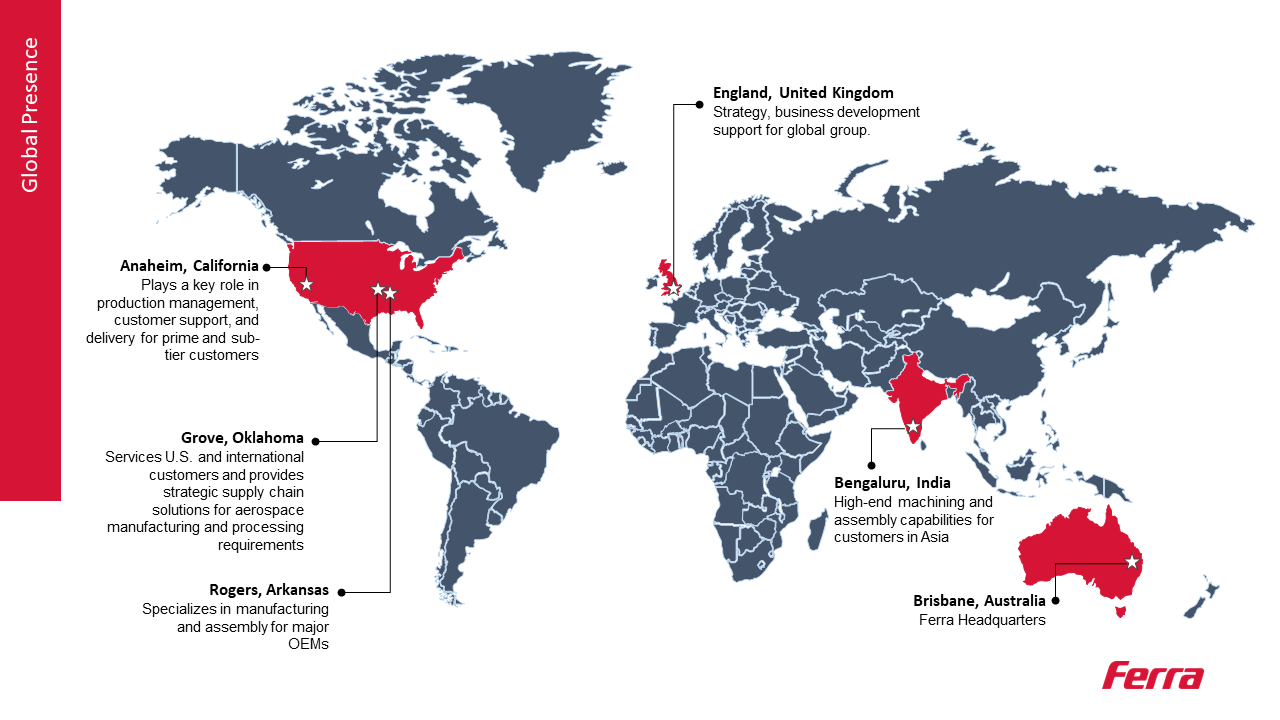

The company’s presence in Australia, United States of America, India, and the United Kingdom, provides it with a strategic leverage of cost-effective manufacturing, advanced technologies and techniques and the ability to provide multi-regional delivery of services to its customer base. Ferra’s global headquarters in Brisbane, Australia has created a global supply chain business model and manufacturing processes that have been adopted across the Ferra Group internationally. This case study examines Ferra's India entry, its in-house manufacturing and engineering services and how Ferra India is providing end-to-end services to its global customers.

Introduction

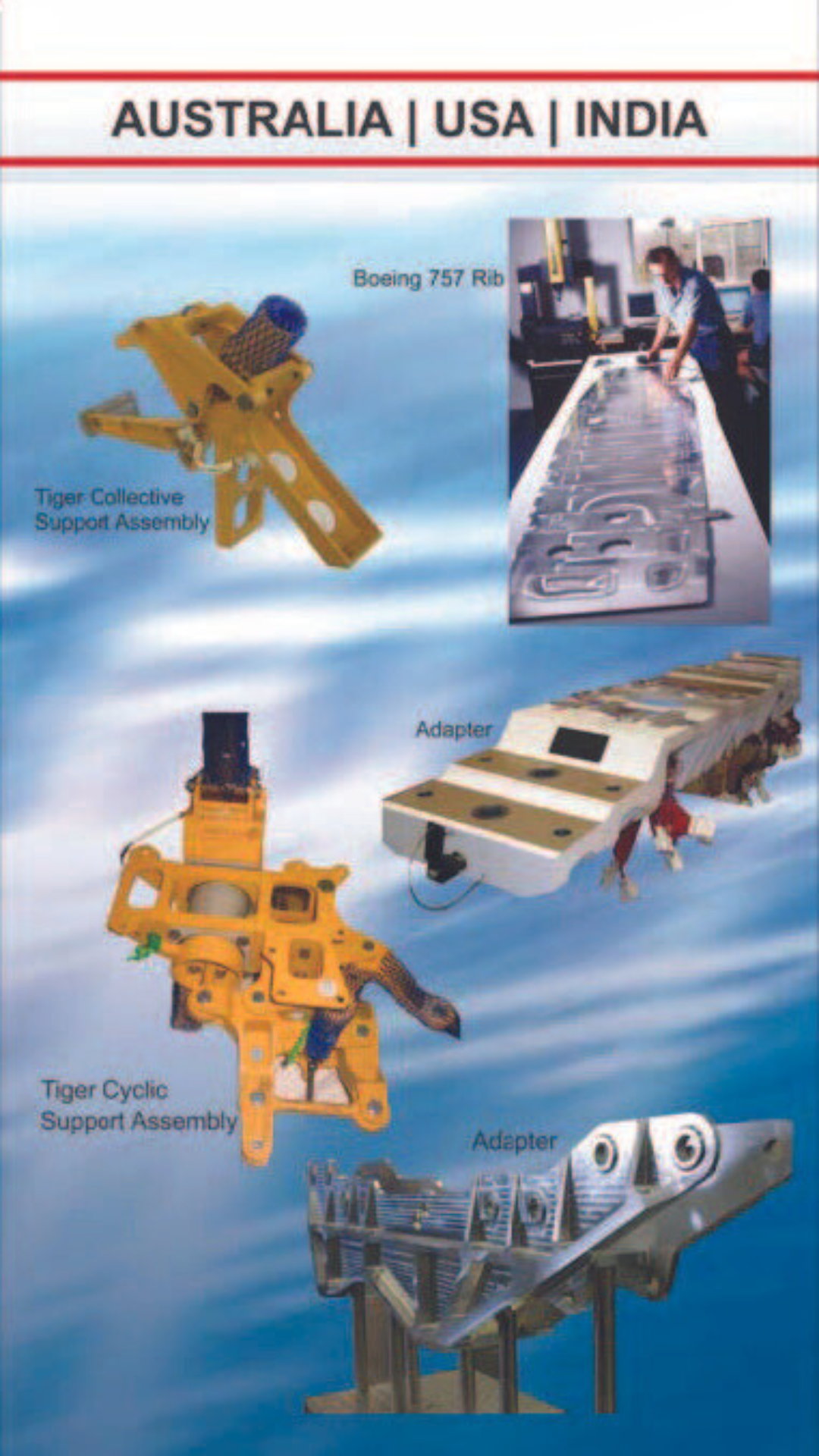

Ferra has received praise from Lockheed Martin as one of the best performing Weapon System suppliers for its delivery of Weapon Adapters for the F-35 Joint Strike Fighter. It manufactures and integrates advanced technology aerospace subassemblies for the F-35 Joint Strike Fighter, the F/ A-18E/F Super Hornet, the MQ-28 Ghost Bat and has delivered the Joint Direct Attack Munition Extended Range (JDAM-ER) Wing Kits.

Ferra invests in research and development as well as in process improvement and advanced manufacturing techniques. It supplies over 100 parts for the F-35 program to Lockheed Martin and Northrop Grumman and is qualified for the supply of vacuum brazed chassis for use on the F-35. Ferra is a classic example of Australia’s capacity for advanced, sophisticated, and high value manufacturing driving the defence and aerospace sub-system development, manufacturing, and integration.

India Strategy

Ferra Aerospace India was established in April 2011 in Bangalore (Bengaluru), Karnataka to build its strategic presence in Asia, and meet customers’ needs both from a commercial and defence perspective in the region. Ferra India manufactures complex components that require high-end machining.

Karnataka is India’s leading State in the aerospace industry, it has been a pioneer in developing aircraft and helicopters for defence and civilian use. The State houses many critical Public Sector Units (PSU’s) involved in the aerospace industry, such as the Aeronautical Development Agency (ADA), National Aerospace Laboratories (NAL), Bharat Heavy Electricals Limited (BHEL), Gas Turbine Research Establishment (GTRE), Bharat Earth Movers Limited (BEML), Indian Space Research Organisation (ISRO), Aeronautical Development Establishment (ADE) and Hindustan Aeronautics Limited (HAL).

HAL has designed, manufactured, and overhauled fighter planes as well as helicopters, transport aircraft, engines, avionics and met system requirements of the Indian Air Force. It has also been a major partner for the space program of the Indian Space Research Programme (ISRO), manufacturing structures and assemblies for the launch vehicles and satellites at its aerospace division. In 2013, Karnataka became the first Indian State to declare an aerospace policy, with its focus on developing aerospace and defence hubs within the State.

The State’s capital city, Bengaluru, now houses one-fourth of India’s aircraft and spacecraft industries and produces 67 percent of planes and helicopters for the country’s defence services. The strong domestic demand for air travel and large defence requirements in India have led major aerospace players to recognise India as an important future market.

“As a part of our global expansion, we realised the advantages in setting up capabilities in the Indian region.” – Sridhar Chintha, Managing Director, Ferra Aerospace India

“Bangalore is renowned as the Aerospace capital of India and has attracted several other industry partners and suppliers as well. There is also an abundant availability of qualified engineers and training centres that proved conducive for our initial set up.”

Unlike the commonly advised joint venture route, Ferra decided to set up its office in India as a foreign owned entity. They developed their India-presence using the support of their Australian entity. The core goal was to create a strategic advantage for the company by delivering on India’s domestic requirements, and maximising on local and global export opportunities, utilising its established supplychain network spread across continents. Ferra India played a key role in several projects for Boeing, including the 737, 747-8, 777, F/A-18, CH-47, P8, BDA Currawong parts and JDAM-ER.

Ferra’s initial India strategy was based on thorough market research and analysis, with the goal of building a manufacturing centre that can provide reliable products and dependable services to customers and address industry requirements.

The new Bangalore-based global centre in India, offered attractive options to customers on price competitive projects, and bolstered their regional partnerships in the market. Ferra India’s clients include Godrej Aerospace, with whom it is a supplier for the A330 Flap Track Beam Project, and the Godrej Long Range Land Attack Cruise Missile project.

“We were not completely successful in advocating our growing competency to potential Indian customers with our group work alone. Many were more interested in our local capabilities specific to their project requirements than our credentials at the group level”.

“We had to tweak our strategy to add more capabilities locally and establish a more matured supply chain.”

“We had to focus on setting up new partnerships in this region by supporting customers’ needs with machining requirements and growing up the value chain with our outstanding performance and increasing contributions.”

Ferra India began executing smaller projects as test cases and evaluated results to understand their competitive advantage, value-add and value creation. Low margins and price sensitivity in a competitive market like India was a key concern for them.

“We found the need to partner with customers, understand their needs more diligently, and build greater levels of trust through consistent top-class performance.”

“Greater utilisation of the local supply chain and delivering more value-add for the project needs were identified as opportunities to increase margins.”

On being asked, if given a choice to do it all over again, what would you do and not do? Ferra Aerospace India suggests that extensive research is integral to establishing business in the new market. An area they believe, they could have invested more heavily in and tested their strategy more robustly prior to investment.

“The possibility of establishing two separate business units to suit both export (EOU/SEZ) and domestic needs (DTA) exclusively may have provided more initial advantage to us. We would have looked to procure more locally made machine assets whose capability and competency is on par with other global suppliers. We would have built partnerships and synergies with businesses of similar cultures and capabilities in our earlier years.”

“We would have invested more in gaining knowledge and awareness on India’s Custom Duty Exemption schemes for Export works.”

“Your establishment strategy and business case analysis for business in India should be created, communicated, reviewed, refined, and reviewed again with both Australian and Indian stakeholders prior to embarking on business establishment. This preparedness will pay dividends when deep into execution of strategy and difficulties arise.”

“One should learn the evolving business culture, industry trends, and policy differences in India, be able to embrace these differences and don’t view them as a hurdle.”

“One should organise regular cross-training and collaborative opportunities between team members in Australia and India. They will learn more about each other and thereby build synergies, and knowledge centres of excellence that can be applicable for all.”

Seeing The Future

The Government of India has identified the Aerospace and Defence sectors as a focus area for its ‘Make in India’ program, with the goal of establishing indigenous manufacturing and modernising its defence and aerospace sectors. This is thoroughly evident in the substantial changes introduced in the defence policy framework, opening of the sector for private and foreign participation (FDI limit increased from 49 percent to 74 percent under the automatic route and up to 100 percent through the government route), based on the cornerstone of indigenous manufacturing and value addition.

India has the world's third-largest defence expenditure, as of 2021, and expects to export equipment worth US$15 billion by 2026. India’s emergence as a defence-manufacturing hub will

be driven by its infrastructure and research and development ecosystem. In the past few months, India has secured an export order worth $155 million for 155-mm artillery guns and another deal for supplying Teevra 40-mm guns to the Indonesian Navy. Armenia has signed a $250 million contract for India’s Pinaka missiles.

India is finalising a Brahmos deal with Indonesia and a follow-on deal with the Philippines over and above the $375 million Brahmos deal signed last year. India is supplying air-to-air missile launchers and sub-systems to MBDA France for Rafale fighter jets. India also exports bulletproof jackets, ballistic helmets, snow boots, and night vision devices used by soldiers in Europe, West Asia, Africa, and ASEAN nations. India is making aerostructures for American Defence giant Boeing's AH-64 Apache helicopters. Airbus Defence and Space recently signed a $2.7bn deal to build C-295 medium-lift transport aircraft at Vadodara. Another American defence giant, Lockheed Martin, has tied up with India to make wing sets for the F-16 Block 70 fighter aircraft. The Indian Army recently handed over 159 indigenously developed vehicles and equipment for UN Peacekeeping mission at United Nations Interim Security Force (UNISFA), Abyei.

With the sector at an inflection point, the signing of the Australia-India Economic Cooperation and Trade Agreement (AI-ECTA) is a positive step forward for solidifying trade and investment ties between both nations, providing supply chain resilience across the critical sectors of defence and aerospace.

Planning Ahead

India’s Defence Procurement Policy encourages joint development, design, and production with foreign original equipment managers. The preferred route of capital acquisition is based on purchasing from Indian vendor products that are either a) indigenously designed, developed, and manufactured with at least 40 percent indigenous content; or b) not indigenously designed or developed but have at least 60 percent indigenous content. The model seeks to identify a few Indian private companies as strategic partners who would initially link with shortlisted foreign original equipment managers to manufacture major military platforms, lay a strong foundation for the Indian defence industry by making a long-term investment in production, research and development infrastructure, creating a wider vendor base, nurturing a pool of skilled workforce, and committing to indigenisation and technology absorption.

“Any new business entering the Indian market should work on building their brand. They should have good marketing expertise to support their strategy and demonstrate the value proposition to customers.”

Key takeaways for aerospace and defence companies from this case study are –

- Gain clarity on local government and industry policies

- Have a clear understanding of stakeholders, departments involved in issues of policy and procurement

- Build a good local team that has familiarity with the domestic industry, and exposure to global industry requirements

- Upskill the workforce by providing sustained opportunities for growth

- Invest time in establishing trustworthy partnerships in India

- Consider location in cities/states which already host defence industry clusters, such as Bengaluru and Hyderabad

- Tap into the large and growing Indian defence procurement market through partnerships with Indian SMEs to manufacture components for global companies with offset obligations in India

- Ongoing defence partnerships between both countries also open opportunities across other segments that includes training, cyber security etc.

Ferra Aerospace India, maximising on its ambitions, can also celebrate its recent Memorandum of Understanding (MoU) with Bangalore-based Dynamatic Technologies Limited (global contributor to the aerospace industry and has strong links with defence and aerospace Original Equipment Manufacturers (OEMs) in India and around the world) to enhance their scale and capabilities in strategic aerospace manufacturing. With India’s market opportunity of cost arbitrage along with skilled manpower and developed infrastructure, to address the South Asia market, the collaboration between both companies is focused on product integration, testing, technology development of airframe structures and precision aerospace components.

Ferra Aerospace India, by expanding its capabilities strengthens, the company’s manufacturing base that also supports their Australian programs and initiatives, which are delivered from their Brisbane-headquarters in Queensland.

“Leadership should demonstrate a strong commitment to succeed in India to its employees, stakeholders and customers and demonstrate how that commitment will grow industrial benefits for both India and Australia in the longer term.”