"We are crafting a future where building materials can store carbon, not emit it."

Context & Opportunity

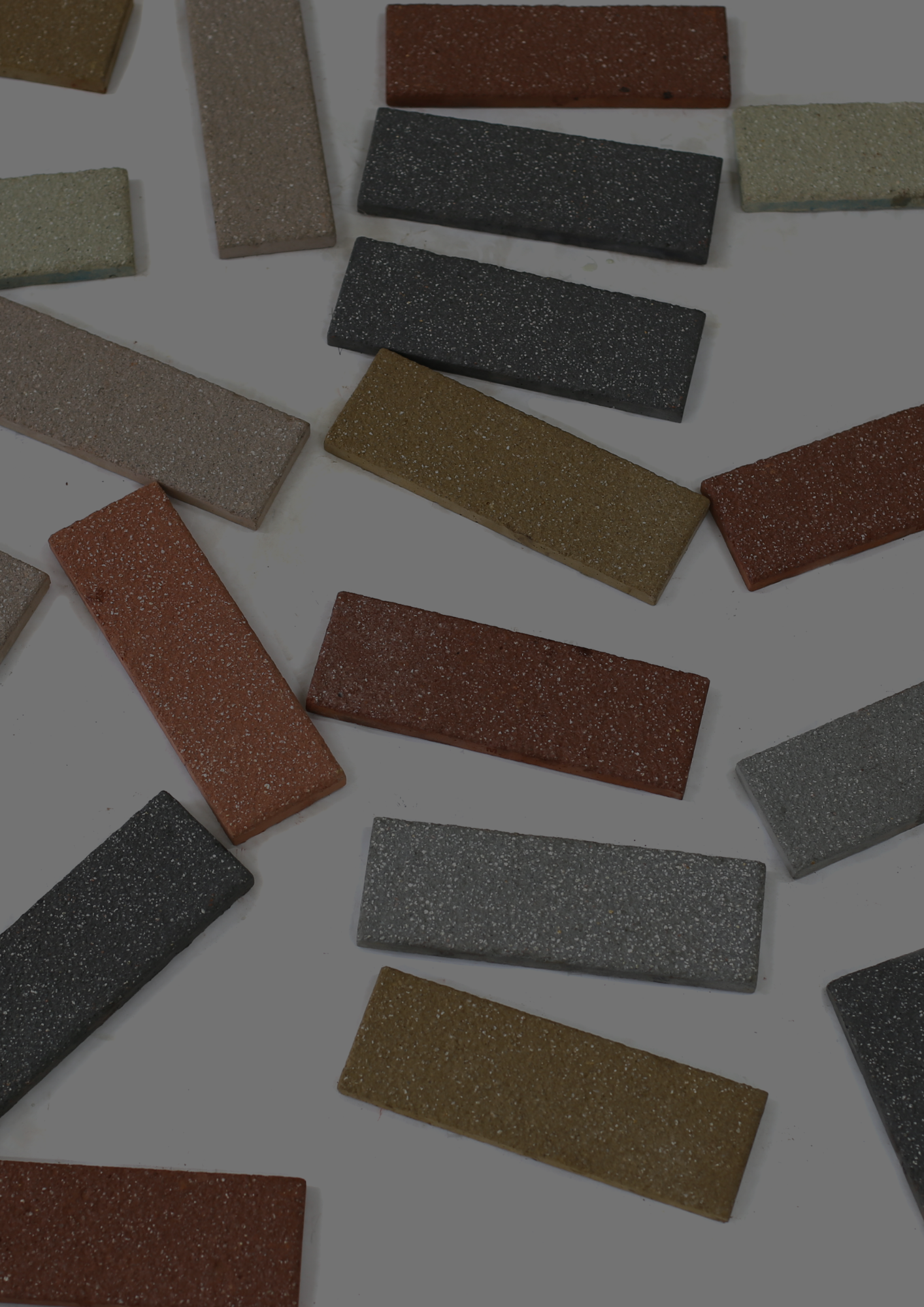

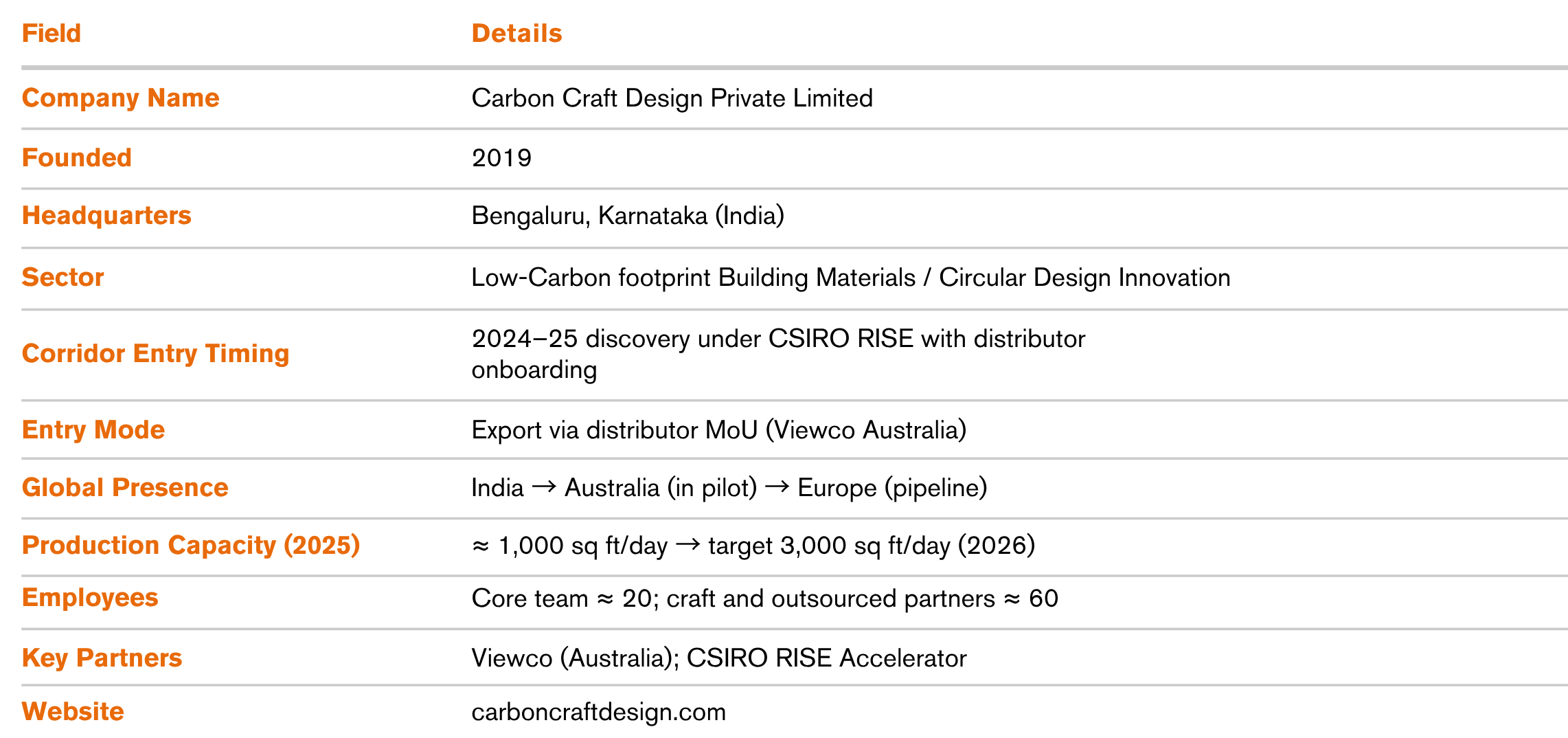

Carbon Craft Design Private Limited, founded in 2019 in India by Architect and biomimicry researcher Tejas Sidnal, transforms industrial by-products and captured carbon waste into low-energy, high-design building materials. Sidnal’s background at the Architectural Association, London, and his biomimicry research inspired a series of experiments that evolved from handcrafted floor tiles to carbon tiles, and now to semi-automated wall cladding designed for faster scale and global export readiness.

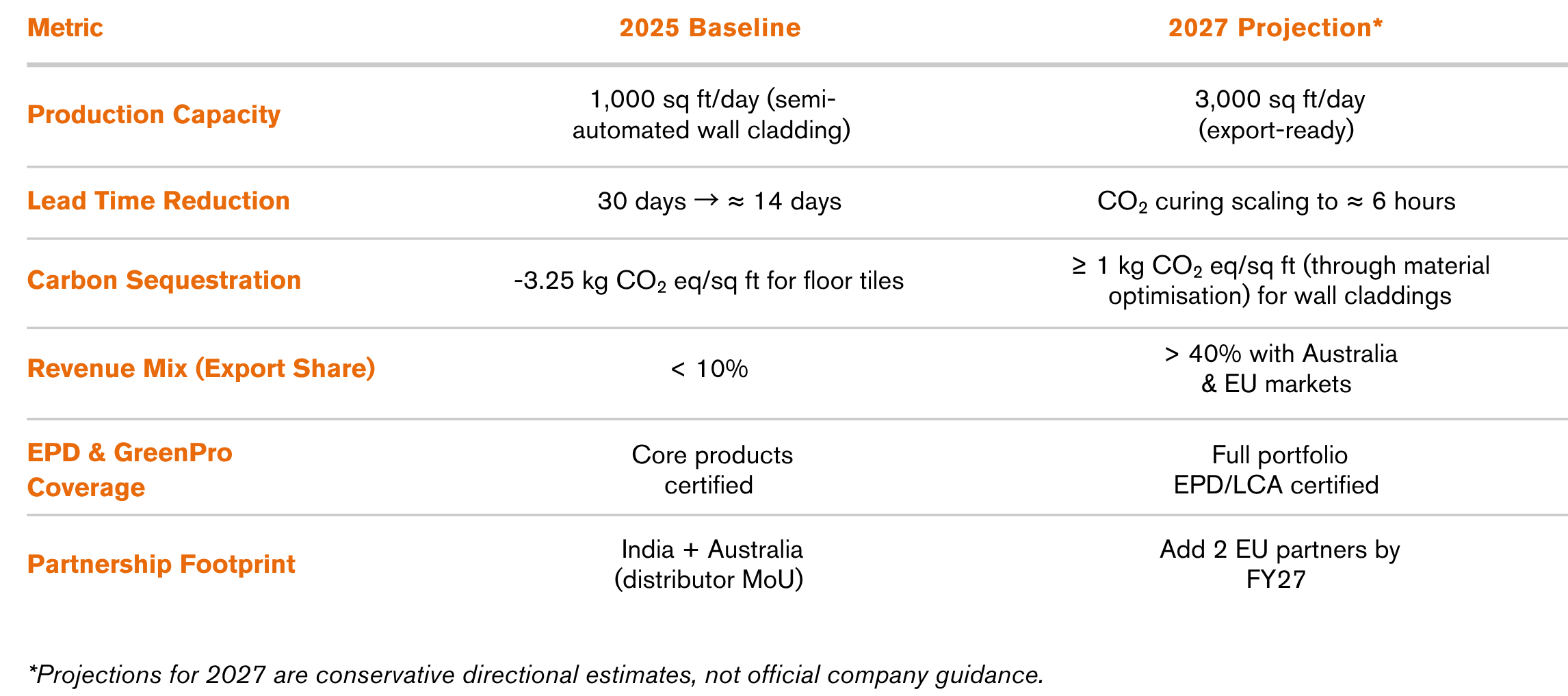

The firm’s early learning curve was steep. Handcrafted floor tiles required month-long water curing, limiting thickness, size, and throughput. Laboratory trials of CO₂ curing reduced curing time to around six hours, and the company’s semi-automated wall-cladding line now delivers within two weeks, preserving craft value while achieving industrial efficiency. Visible reference projects, including Adidas flagship stores in Mumbai and Delhi and the National Gallery of Modern Art (NGMA), Mumbai, have anchored its credibility with architects and specifiers, while pilots under discussion with Royal Enfield and Tata Group signal mainstream acceptance.

The macro context is compelling. Buildings and construction account for roughly 39% of global energy and process-related CO₂ emissions, and embodied carbon has shifted from a niche sustainability concern to a procurement criterion in advanced markets. In Australia, the National Construction Code 2022 lifted minimum residential performance to 7 Stars, while Green Star and EPD (Environmental Product Declaration) frameworks now emphasise upfront embodied-carbon disclosure.

Corridor policy momentum reduces trade friction. The Australia–India Economic Cooperation and Trade Agreement (AI-ECTA) entered into force in December 2022, with 96% of Indian imports already tariff-free and near-total coverage expected by 2026. CarbonCraft currently produces around 1,000 sq ft per day, with distributor feedback indicating the need to triple capacity to 3,000 sq ft per day to meet projected Australian and European export demand.

Strategy & Execution

Distributor-Led Entry and Market Sequencing

CarbonCraft’s go-to-market playbook is defined by channel access, manufacturability, and specification speed. Its entry into Australia follows a distribution Memorandum of Understanding (MoU) with Viewco, a glazing and façade-solutions specialist with architect-facing showrooms across New South Wales and the Australian Capital Territory. This distributor model delivers capital-light visibility to qualified demand while accelerating discovery through showroom-led engagement. Market sequencing is intentional

- India first – build references, prove durability, refine finishes.

- Australia next – execute pilots under AI-ECTA conditions through Viewco.

- Europe later – expand once export and certification maturity are achieved.

Time-boxed discoveryvisitswith Viewco validated texture, colour, and formatpreferencesfor the Australian market, ensuring alignment before the first commercial shipment

Product Architecture and Localisation

Transitioning from floor tiles to lightweight wall cladding has been decisive. The move reduced curing and fulfillment time from 30 days to roughly 14, enabling CarbonCraft to scale quality without sacrificing craft identity. Production capacity currently stands at ≈ 1,000 sq ft per day through an outsourced semi-automated line near Karnataka, with plans to triple output for export readiness.

Raw-material resilience is secured through industrial by-product partnerships within 200 km, stabilising colour, texture, and strength while reducing transport-energy intensity. The process substitutes low-energy semi-automation for high-heat sintering typical of ceramics, yielding substantial carbon savings.

"Our mission is to turn industrial byproducts into beautiful, responsible materials architects love to specify.

Certification and Policy Alignment

CarbonCraft’s competitive edge lies not only in product innovation but in documentation discipline.The company backs its environmental claims with Environmental Product Declarations and GreenPro certification, ensuring compatibility with IGBC, LEED, and Green Star rating tools. Its materials are carbon-negative, with verified carbon footprint of -3.25 kg CO₂ eq per sq ft for floor tiles according to LCA. Laboratory CO₂-curing studies are now being scaled for production, expected to cut working-capital cycles by up to 85% once fully deployed.

Policy enablers reinforce execution:

- CSIRO’s RISE Accelerator provided internationalisation mentorship and corporate introductions.

- AI-ECTA tariff relief improves landed-cost competitiveness.

- NCC 2022 energy-efficiency and embodied-carbon provisions create demand pull for documented low-carbon materials.

"Our focus is clear, design for speed, document the carbon math, and target markets where regulation rewards it.

Impact & Results

CarbonCraft’s results can be viewed through four lenses: commercial traction, operational efficiency, ESG performance, and corridor readiness.

- Commercial traction:

Flagship installations with Adidas and NGMA have shortened sales cycles and established design credibility among mid-tier developers seeking sustainability with aesthetics.

Active discussions with Royal Enfield and Tata Projects mark potential for institutional adoption. - Operational efficiency:

Curing time reduced from 30 days to ≈ 14 days; throughput now at ≈ 1,000 sq ft/day with planned ramp-up to 3,000.

Local feedstock partnerships have stabilised inputs and reduced logistics energy. - ESG credentials:

Verified carbon-negative footprint (–3.25 kg CO₂ eq/sq ft), supported by EPD and GreenPro certifications.

Product performance aligns with LEED v4.1 MRc1 and Green Star Upfront Carbon Credit pathways. - Corridor readiness:

Under AI-ECTA, Indian building materials enjoy tariff-free entry; NCC 2022 and NatHERS updates accelerate compliance demand for low-carbon finishes.

CarbonCraft’s documentation and distributor-based route position it as export-ready for 2025–26 pilots.

"Architects are the key decision-makers; even with distributors, we’re building our own architect community.

Lessons & Insights

Market Entry & Execution

Mid-market Indian developers adopt innovation faster than legacy majors, visible performance and assured lead times outweigh abstract sustainability messaging.

Core Takeaway

Focus first on speed-to-specification, not sustainability evangelism.

Policy & Regulatory Friction

India’s fragmented green-rating adoption means price remains dominant, whereas Australia’s codes monetise carbon transparency.

Core Takeaway

Prioritise markets where regulation translates sustainability into scoring advantage

Partnerships & Localisation

Early emphasis on handmade floor tiles constrained scale. The pivot to semi-automated wall cladding restored speed and profitability.

Core Takeaway

Marry craft identity with process engineering for scalable design credibility.

Partnership and Channel Learning

Enterprise pilots proved slow; medium-sized builders and architect networks converted faster.

Core Takeaway

Distributor access accelerates discovery, but direct architect communities drive specification.

Strategic Discipline

Accelerator support (RISE), EPD-based documentation, and selective automation reveal a pattern of measured, evidence-led growth.

Core Takeaway

Structure internationalisation as a three-phase journey, research, reference, regulation.

Over the next 24–36 months, CarbonCraft aims to:

- Triple daily capacity to ≈ 3,000 sq ft,

- Complete Australian pilots with Viewco and transition to commercial exports under AI-ECTA,

- Secure European distribution partners,

- Expand EPD/LCA coverage across all SKUs.

With carbon disclosure tightening across OECD markets, CarbonCraft’s low-energy, design-led materials occupy a strategic sweet spot, cost-competitive, auditable, and aesthetically differentiated.

As building codes converge toward carbon accountability, the company’s export-ready documentation and distributed manufacturing model offer a five-year pathway to global corridor leadership in carbon-negative design materials.

All information has been verified from primary company submissions, official filings, interview transcripts, and secondary materials cited in the References section.

Company Snapshot

KPI Impact Snapshot