"We are not just creating an alternative material, we are building a platform for plastic-free innovation that can transform global supply chains."

Context & Opportunity

Founded in 2023

Founded in 2023 by former advertising executive Tina Funder, Alt. Leather has positioned itself as Australia’s first 100% bio-based, plastic-free leather alternative company.

The Melbourne-based start-up transforms agricultural waste and regenerative plants into premium biomaterials targeted at fashion, footwear, automotive, and furniture industries. Funder’s transition from an 18-year career in global advertising to entrepreneurship was shaped by her experience building LOM Australia, a premium vegan handbag label. The venture revealed a stark reality: most so-called “sustainable” leathers still relied on petroleum-based plastics, exposing a critical gap in the market for genuinely circular, plastic-free alternatives.

The rise of plant-based leather

The timing aligns with a structural shift in the global market. The plant-based leather segment, valued at US$122.6 million in 2023, is projected to reach US$394.9 million by 2032 (13.9% CAGR). Broader analyses of the vegan leather category forecast valuations of up to US$27.8 billion by 2034, underpinned by escalating regulatory and consumer pressure on fashion and luxury supply chains.

The backdrop is urgent: fashion accounts for ~10% of global carbon emissions, while leather production is one of the most resource-intensive and environmentally destructive processes, contributing significantly to deforestation, water stress, and toxic chemical discharge.

The Australia–India corridor provides Alt. Leather with a distinctive pathway to scale. The Australia–India Economic Cooperation and Trade Agreement (AI-ECTA), implemented in December 2022, liberalised trade across 6,000 tariff lines. India gained duty-free access to Australian markets in textiles and leather products, while 96.4% of Indian exports now enter Australia tariff-free. With 4.42 million workers employed in India’s leather industry and annual exports of US$4.69 billion, the corridor represents both a sourcing base and a manufacturing springboard.

Against this backdrop, Alt. Leather identified its strategic white space: no commercially viable, 100% plastic-free, plant-based alternative existed that could meet international standards of durability, flexibility, and aesthetic appeal. By leveraging Australia’s R&D excellence through CSIRO partnerships and India’s scale and craftsmanship in leather manufacturing clusters such as Tamil Nadu and Uttar Pradesh, Alt. Leather is positioned to bridge innovation with industrial execution. The result is a differentiated solution that addresses global sustainability imperatives while embedding itself in one of the world’s most important manufacturing corridors.

Strategy & Execution

Phased entry model

Alt. Leather has pursued a phased entry model anchored in ecosystem integration, leveraging public–private programmes and strategic partnerships to accelerate scale while conserving capital.

The journey began in 2023 with CSIRO’s Kick-Start programme, which provided access to specialised testing facilities and equipment worth over $500,000 in commercial value. This infrastructure was critical in validating the material’s performance: initial lab formulations progressed through curing ovens to small-scale extruder trials, eventually scaling to industrial extruders at CSIRO’s Food Innovation Centre in Werribee. The breakthrough came when the material replicated the look, feel, and durability of animal leather, establishing proof of concept and scalability.

Building on this foundation, Alt. Leather was selected in 2024 for the India–Australia RISE Accelerator, a joint initiative of CSIRO and India’s Atal Innovation Mission (AIM). This programme facilitated high-level introductions to premium manufacturers in Chennai and Noida, both integrated into global supply chains for European and American brands. These partnerships enabled the company to embed its sustainable materials into facilities already certified for international export markets.

Rather than investing US$15–25 million in proprietary factories, Alt. Leather adopted a distributed partnership model, tapping into India’s established leather ecosystem. Collaborations with two leading manufacturers allowed the company to access world-class craftsmanship while trialling real-world production runs.

These pilots revealed operational bottlenecks and informed refinements to improve efficiency at industrial scale. To safeguard intellectual property, the company implemented a rigorous legal framework including NDAs, Material Transfer Agreements, and MOUs ensuring technology transfer without dilution of core know-how. This approach provided immediate access to global production capacity while mitigating regulatory and financial risk.

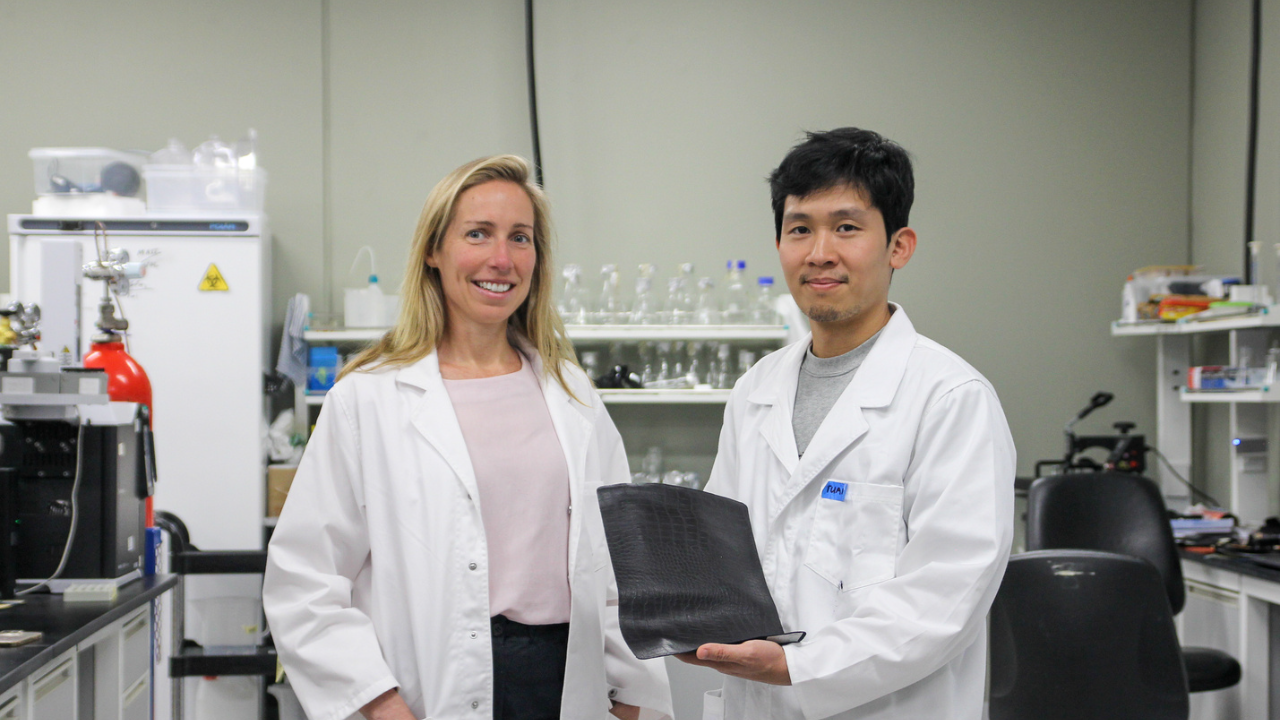

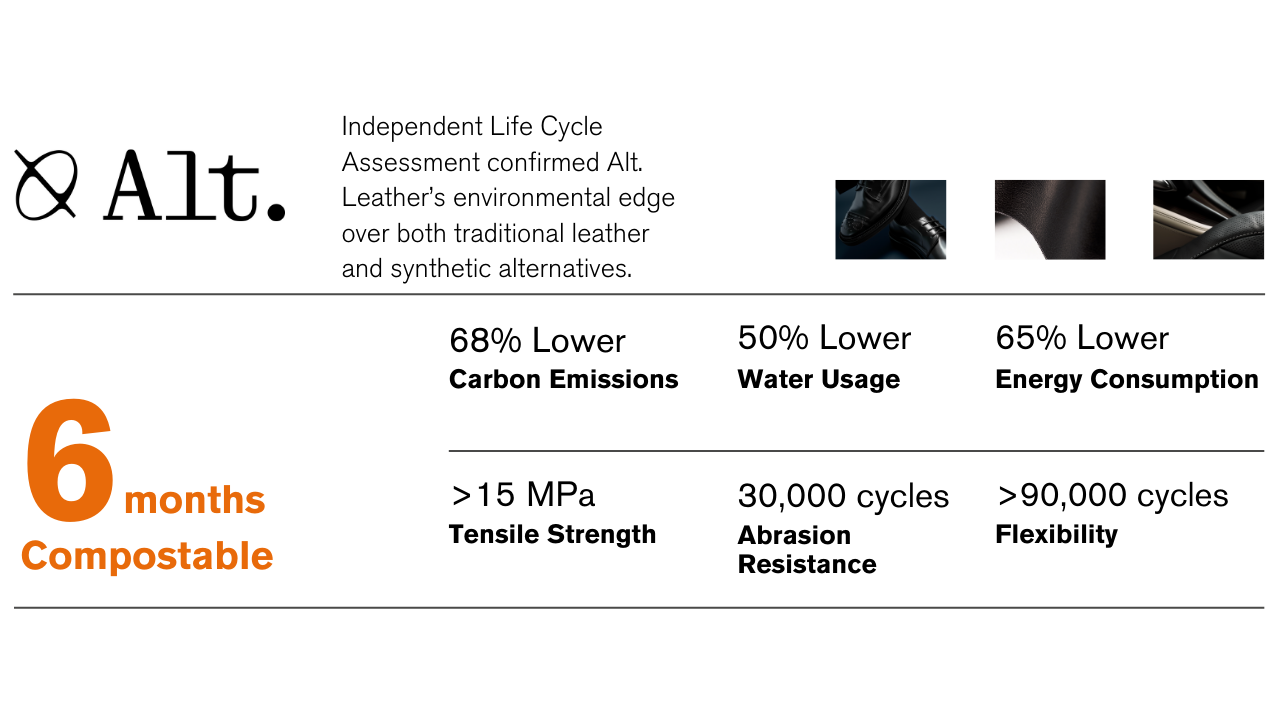

At the core of Alt. Leather’s innovation is its proprietary bio-resin technology, developed under the leadership of Chief Scientific Officer Dr. Tuan Nguyen, formerly of CSIRO Materials Science. The research team expanded from one to four scientists in 2023, supported by successive funding rounds and government grants. By screening over 1,000 ingredient combinations, the team optimised formulations to meet stringent ISO standards: tensile strength above 15 MPa, abrasion resistance exceeding 30,000 cycles, and flexibility beyond 90,000 flex cycles. The company’s green chemistry approach combines polysaccharides such as cellulose and starches with recycled and regenerative fibres, incorporating 5-10% upcycled content. Independent Life Cycle Assessment by Lifecycles confirmed significant sustainability gains, 68% fewer carbon emissions than leather, 50% less water consumption, and 65% lower energy use compared with synthetics. Further end-of-life testing with the University of Newcastle revealed the material is fully compostable within six months and contains no petroleum-based plastics, addressing both environmental mandates and consumer expectations.

Alt. Leather has also been deliberate in maximising government and ecosystem leverage. Private funding of $1.1 million in December 2023, led by Austin Group, Wollemi Capital Group and supported by Startmate, , LaunchVic’s Alice Anderson Fund, and Main Sequence Ventures, was oversubscribed. This was complemented by $1.15 million in federal support through the Industry Growth Program in August 2025, directed toward R&D acceleration and pilot-scale production. These resources have underwritten capability expansion, IP filings, and early-stage commercialisation.

Strategically, the combination of CSIRO partnerships, accelerator platforms, and bilateral programmes has enabled Alt. Leather to de-risk market entry, accelerate credibility, and align with preferential trade provisions under AI-ECTA. By sequencing R&D validation, manufacturing partnerships, and ecosystem engagement, the company has built a scalable playbook for cross-border biomaterials innovation that balances speed, cost-efficiency, and resilience.

"When our sample emerged from the curing ovens at CSIRO, it looked and felt just like leather, this was the breakthrough moment.

Impact & Results

Alt. Leather has achieved critical milestones that validate both its technical capability and market acceptance. The company’s defining breakthrough came in July 2025, when acclaimed Japanese designer Yuima Nakazato featured Alt. Leather in three distinct looks during his GLACIER collection at Paris Haute Couture Week. For a start-up less thanthree years old, this debut on one of fashion’s most prestigious stages provided global visibility and sector credibility that few sustainable materials ventures attain at such an early stage.

This recognition triggered a wave of commercial interest. Luxury brands across fashion, automotive, and furniture began approaching the company for collaborations, underscoring the market’s appetite for plastic-free, bio-based materials. In parallel, Alt. Leather completed sample manufacturing trials with multiple premium leather goods producers, proving its material could meet the durability, flexibility, and aesthetic standards demanded by global brands.

Funding momentum has reinforced Alt. Leather’s trajectory. By 2025, the company had raised AU$2.25 million, channelled into team expansion, IP development, and pilot production scale-up. The oversubscribed seed round, including Wollemi Capital Group (the family office of Tesla Chair Robyn Denholm), signalled strong high-net-worth conviction in the sustainable materials thesis. Participation by Main Sequence Ventures, CSIRO’s deep-tech fund, provided strategic validation that extended beyond financial capital, cementing Alt. Leather’s reputation as a science-led venture with global potential.

These resources allowed the company to scale from a single-founder operation to a multidisciplinary team of four materials scientists plus commercial staff, building the in-house capability required for continuous formulation, testing, and customer engagement.

Independent Life Cycle Assessment confirmed Alt. Leather’s environmental edge over both traditional leather and synthetic alternatives. The material delivers 68% lower carbon emissions, 50% lower water usage, and 65% less energy consumption, while eliminating petroleum-based plastics altogether. Critically, it achieves industrial compostability within six months and avoids the microplastic shedding common to PU- or PVC-based “vegan” leathers.

From a performance perspective, Alt. Leather has cleared rigorous ISO standards on tensile strength (>15 MPa), abrasion resistance (>30,000 cycles), flexibility (>90,000 flex cycles), and colour fastnessestablishing its credentials as a true drop-in replacement for animal leather. Aprovisional patent now protects its proprietary bio-resin composition and processing methods across Australia, creating a defensible IP moat for future scale.

"Partnerships with Indian manufacturers give us the scale and craftsmanship to take a truly sustainable Australian innovation global.

Lessons & Insights

Market Entry & Strategy

Adopted a partnership-first model, leveraging India’s existing manufacturing ecosystem to achieve rapid access without USD 15–25 million in upfront capex.

Success depended on strict IP protection, careful partner selection with proven export track records, and alignment on sustainability and quality objectives.

Real-world production runs in India provided operational insights that planning alone could not deliver, enabling faster optimisation and efficiency gains.

Core Takeaway

Partnerships can de-risk entry and accelerate scale more effectively than heavy capital investment.

Government & Ecosystem Leverage

RISE Accelerator reduced time-to-market by 12–18 months through regulatory guidance, curated partner introductions, and market intelligence.

CSIRO Kick-Start delivered access to specialised equipment, expertise, and credibility worth more than $800,000 in equivalent value.

Value was unlocked not through opportunistic participation, but through disciplined engagement, clear value proposition articulation, and systematic follow-through.

Core Takeaway

Public programmes deliver outsized returns when approached strategically and professionally.

Market Positioning & Customer Strategy

Overcame 35–50% higher production costs by targeting luxury and high-end buyers willing to pay a sustainability premium.

Commercial traction required more than “green credentials”: performance equivalence had to be validated through ISO testing, technical documentation, and brand storytelling.

Educating the market was critical, sustainability claims needed to be backed by proven, LCA and end-of-life credentials, durability and design quality.

Core Takeaway

Premium positioning succeeds only when sustainability is matched with uncompromising performance.

Organisation & Capability Building

Treated ecosystem integration as a core capability, engaging deeply with accelerators, mentors, and institutional partners.

Dedicated resources for relationship management and programme participation positioned Alt. Leather as a credible partner for investors, regulators, and manufacturers.

This approach delivered exponential returns in expertise, networks, and market opportunities far beyond the company’s early size.

Core Takeaway

Ecosystem engagement is a strategic asset that must be resourced, managed, and scaled like any core business function.

Broader Lesson for Cross-Border Business

Alt. Leather shows that partnership-first models, ecosystem leverage, and premium positioning can transform small-scale innovators into credible global players

Core Takeaway

For emerging cross-border ventures, disciplined partnerships and ecosystem integration are as important as product innovation itself.

All information has been verified from primary company submissions, official filings, interview transcripts, and secondary materials cited in the References section.

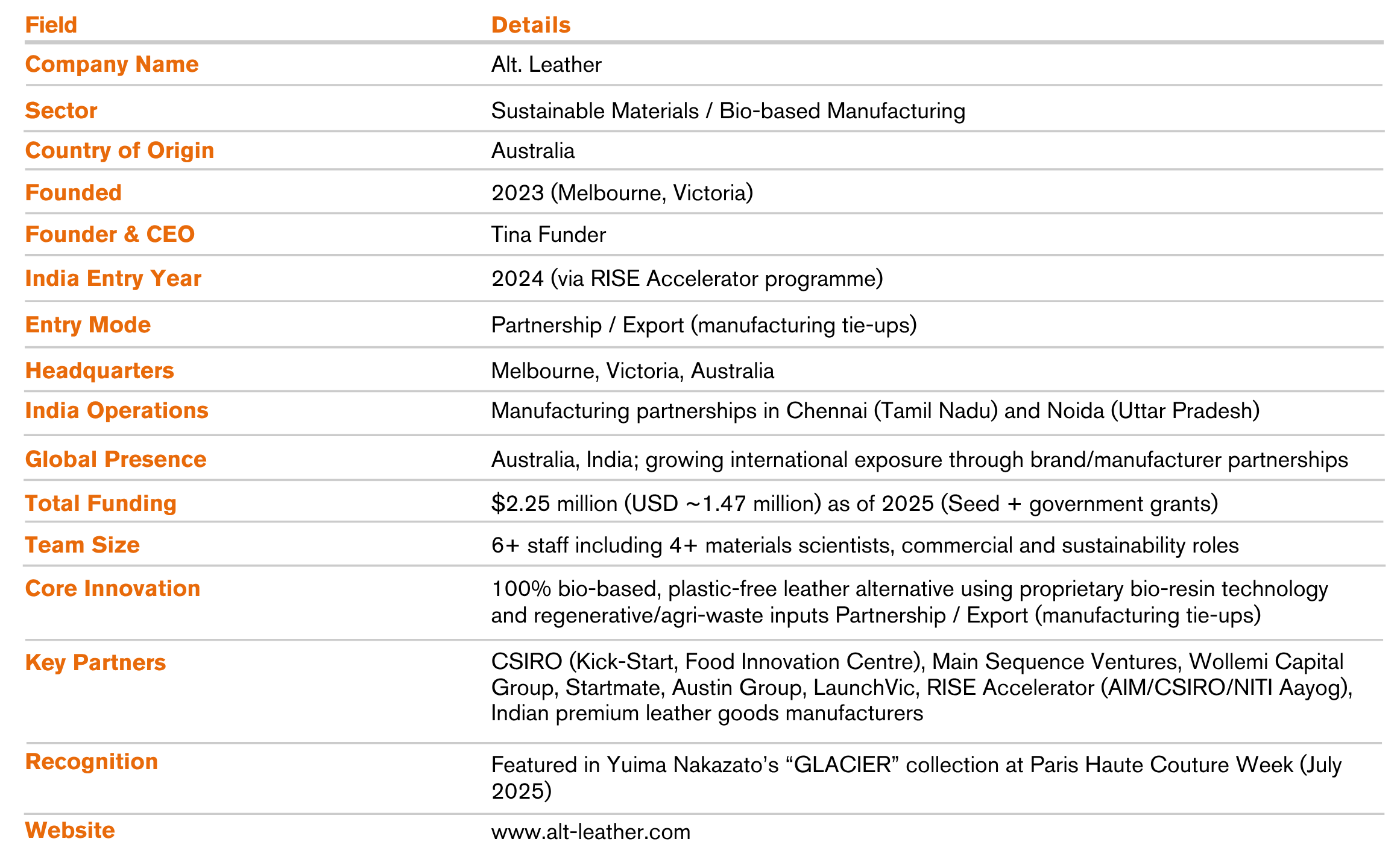

Company Snapshot

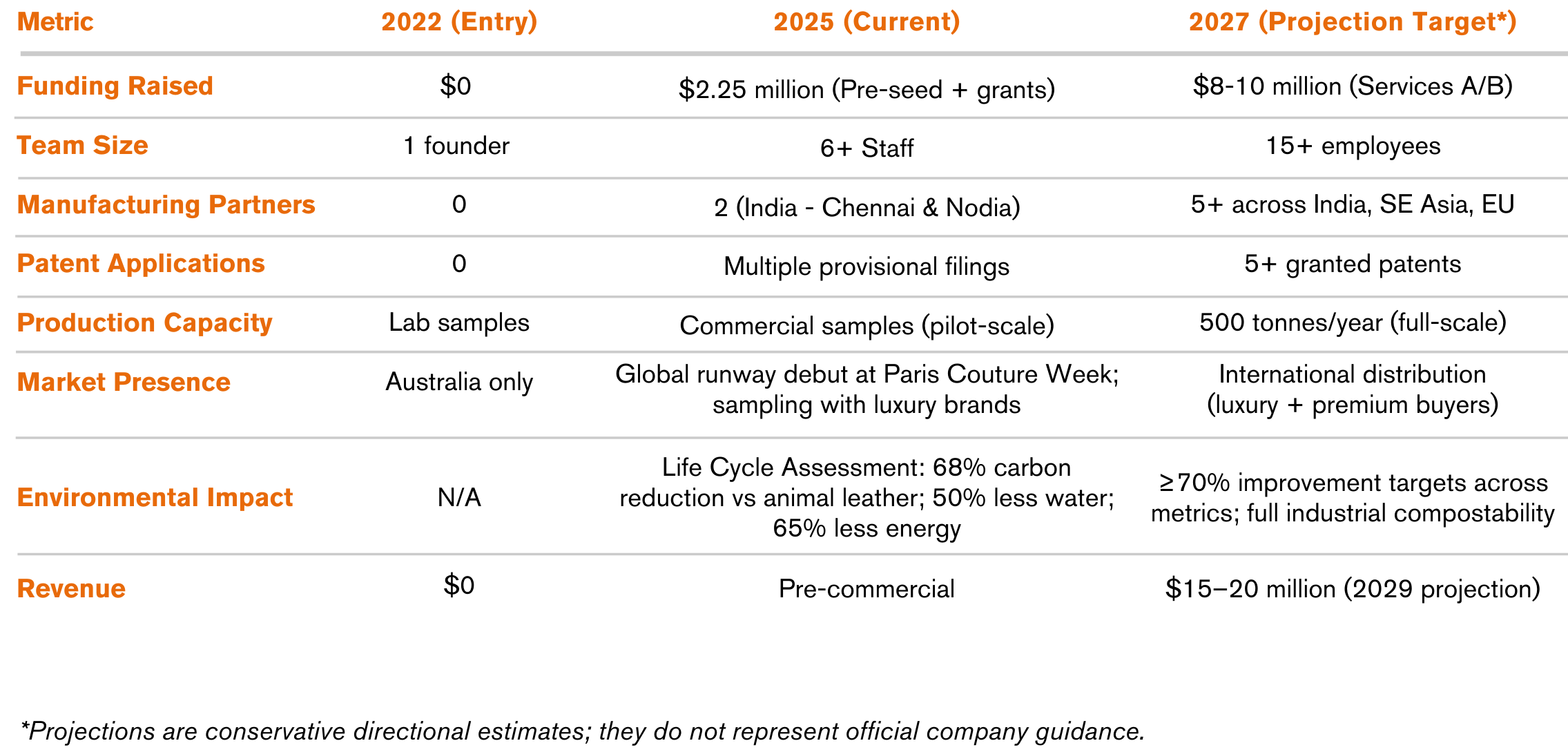

KPI Impact Snapshot